ARTICLE AD BOX

This is a segment from the Empire newsletter. To read full editions, subscribe.

Bitcoin at $90,000 is a reality.

Right now, a lot of market signals point to a continued run-up for bitcoin, though it quickly backed down from $90,000 after initially breaking the new all-time high.

One interesting data point to look at when we have this kind of price action is what’s happening over on CME.

For example, traders are clearly ecstatic about the current setup, with CME trading volumes surging to records after the election. This time last week, on Nov. 6, CME notched its highest notional volume day with over $16.4 billion transacted in over 316,000 contracts.

“As Trump’s win became clear, futures premiums began to soar and have since risen above 15% as BTC continued its rally towards $90,000. Despite aggressive positioning, we note that market tops rarely coincide with CME premiums in an uptrend, a promising indicator for now,” K33 analysts wrote. Open interest on CME grew by $2.4 billion.

Source: K33

Source: K33$100,000 is clearly on the table, and it might even be a reality before the end of the year.

“While the market is due for a breather, we expect prices to head in this direction in the coming weeks. Round numbers tend to be extreme volatility triggers, exemplified by BTC’s $10k breakout in 2017,” analysts Vetle Lunde and David Zimmerman continued.

“The first $10k visit happened on November 29, 2017, a day seeing intraday highs of $11,465 and intraday lows of $8,579, a high-low spread of a massive 34%. A whipsaw of softer magnitude (19%) happened on November 30 before a firm breakout was established on December 1. An eventual $100,000 breakout is well-shaped up to face mirroring volatility.”

Galaxy’s Alex Thorn noted that Monday’s price action in bitcoin notched the “49th biggest gain in history,” though he was careful to highlight that there was a lot of dramatic price action in the early days of bitcoin.

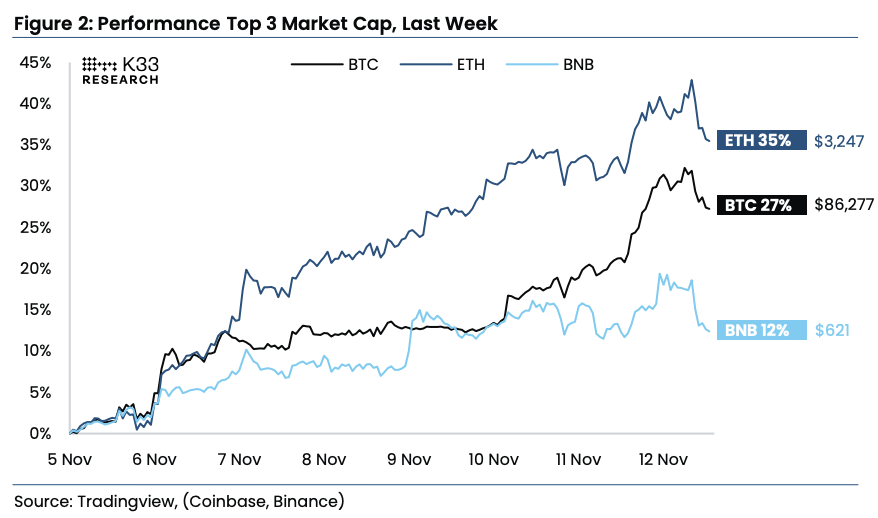

Anyway, we’re obviously not just watching bitcoin, so I wanted to take a look at how the rally could impact other parts of crypto.

“BTC’s momentum has awoken the animal spirits within perp traders, as funding rates continue to soar above neutral levels for both BTC and altcoins, indicating heavy long positioning,” K33 said.

Tie the election outcome to lower interest rates and bam! You have a pretty favorable DeFi environment.

It’s hard not to be a bull these days.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter.

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

9 months ago

451519

9 months ago

451519

English (US) ·

English (US) ·