ARTICLE AD BOX

The top Bitcoin miner, Marathon Digital (MARA), has once again caught the eyes of investors with its recent BTC buying move. According to the latest data, the miner has accumulated 1300 BTC recently, following a similar transaction of 1,423 Bitcoin earlier this week. Notably, this comes after the firm announced the closing of its second $850 million convertible note offering, a move aimed at increasing its Bitcoin buying plan.

Bitcoin Miner Marathon (MARA) Continues BTC Buying Spree

The leading Wall Street players have recently been shifting their focus toward the digital assets space, as evidenced by the massive buying of the players. Despite BTC hitting $100K, it appears that the institutional interest in the flagship crypto remains unaltered.

According to recent data, Bitcoin miner Marathon (MARA) has accelerated its BTC buying plan, as evidenced by the latest transactions. Arkham data showed that MARA has recently acquired 1300 Bitcoin, worth around $130.66 million, from yesterday, sparking market optimism.

Source: Lookonchain, X

Source: Lookonchain, XIn addition, the firm made a similar purchase earlier this week, which has further caught the eyes of the investors. For context, earlier this week, the BTC miner acquired another 1423 Bitcoin, valued at around $139.5 million.

Notably, this substantial purchasing activity comes just after the BTC miner’s announcement of the successful closure of its second $850 million convertible note offering. According to the firm, the primary aim of this strategic move was to accelerate its Bitcoin acquisition plan, while also partially repurchasing existing notes that are set to mature in 2026.

Will BTC Continue To Rally?

BTC price today was up over 1% and exchanged hands at $99,531, making a bounce back from the 24-hour low of $97,629. However, the crypto’s trading volume dropped by 32% to $93,57 billion at the same time. The flagship crypto has touched a 24-hour high of $102,039.88, indicating strong market interest amid Marathon’s buying spree.

According to CoinGlass data, BTC Futures Open Interest was down 0.5% to $61.25 billion in a 24-hour time frame, while noting a slight rebound in the short term. Considering that, it appears that the investors are once again entering the BTC market after a short-term pause.

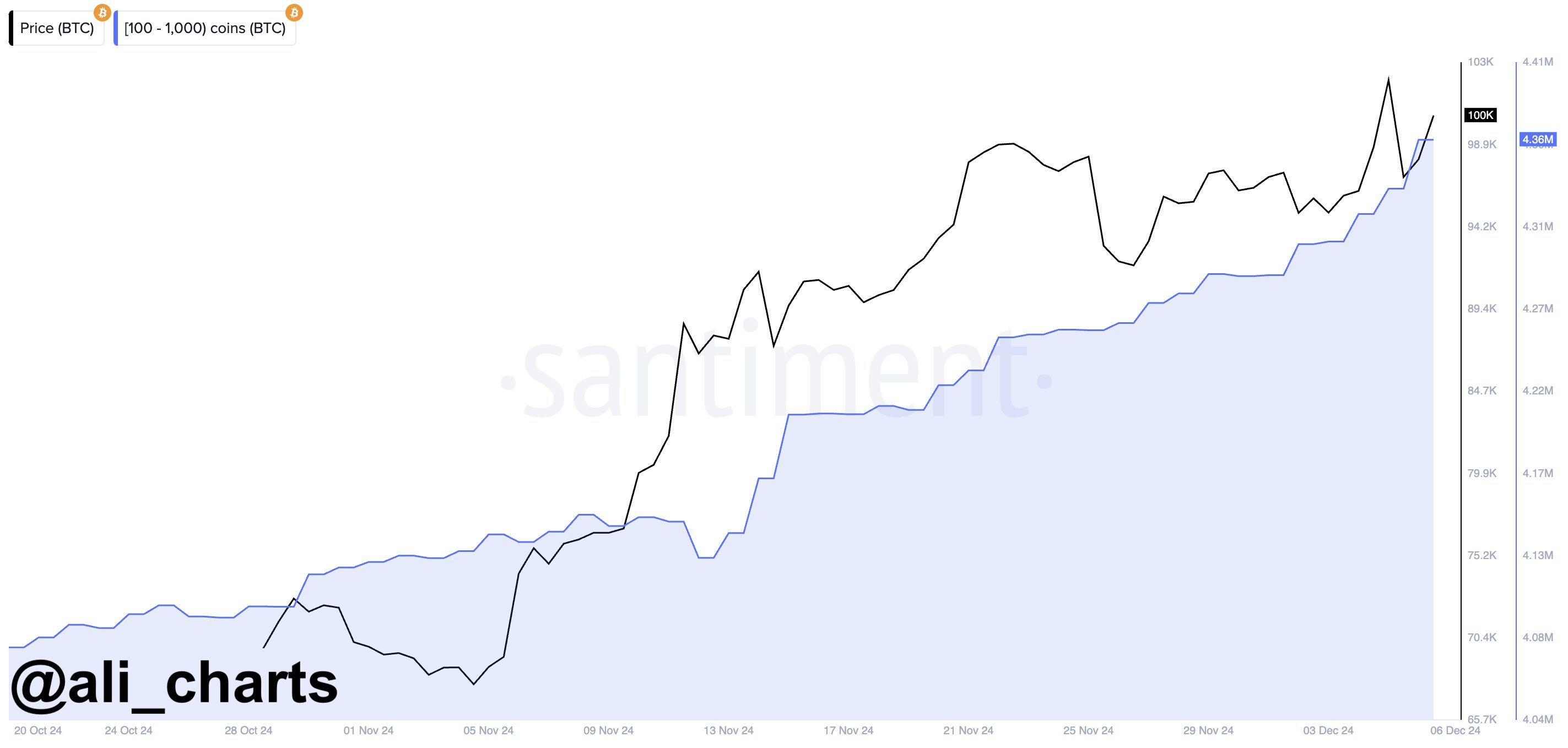

In addition, Bitcoin whales are also on a buying spree alongside the institutions. According to Ali Martinez, the whales have accumulated 20,000 BTC since yesterday, worth around $2 billion, signaling strong confidence in the asset. Having said that, it appears that BTC is likely to set a new record ahead, breaking its ATH of $103,900 attained on December 5.

Source: Ali Martinez, X

Source: Ali Martinez, X

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam's expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news. Rupam's career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

9 months ago

415121

9 months ago

415121

English (US) ·

English (US) ·