ARTICLE AD BOX

Jamie Coutts, chief crypto analyst at Real Vision, predicted that the Bitcoin price could reach $110,000. He revealed what will drive the BTC rally to this price target and discussed what has triggered the market rebound so far. The flagship crypto is again targeting the $70,000 price level, which could pave the way for a new all-time high (ATH).

Bitcoin Price To Hit $110,000

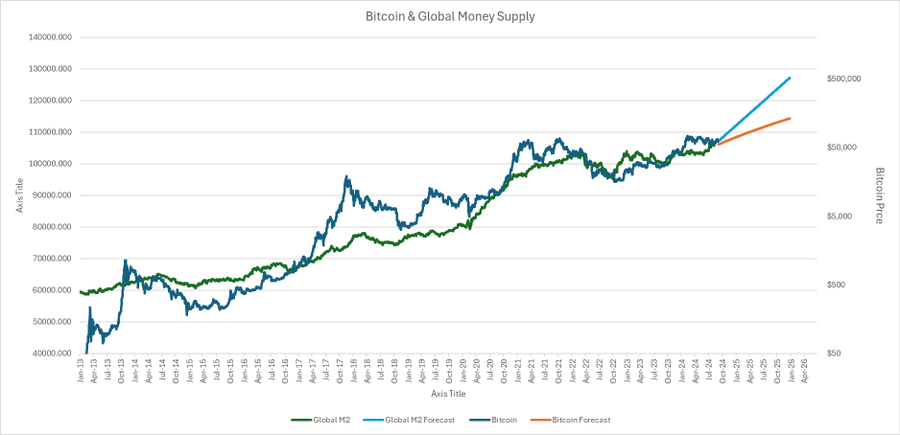

Coutts predicted in an X post that the Bitcoin price could rise to as high as $110,000 as the global money supply continues to reach new highs. The analyst noted that the increasing demand for the flagship crypto and its capped supply means that its price is bound to “rise when more units of fiat enter the system.”

The accompanying chart he shared showed that the BTC price will reach this $110,000 price target as the global money supply hits $500 trillion. The chart also showed that the crypto would reach this target between April 2025 and July 2025. This aligns with CoinGape’s Bitcoin (BTC) price prediction for that period.

Jamie Coutts noted that the correlation between the Bitcoin price and global money supply shows that tracking the liquidity cycle is crucial. He remarked that understanding these cycles provides insights into when new capital will likely enter the market and push prices higher.

In line with this, the analyst claimed that the global money supply’s surge to a new ATH of $107 trillion is 80% the reason for the recent Bitcoin price rally. He added that as more fiat money floods into the economy, some of the capital will flow into “anti-debasement” assets like Bitcoin.

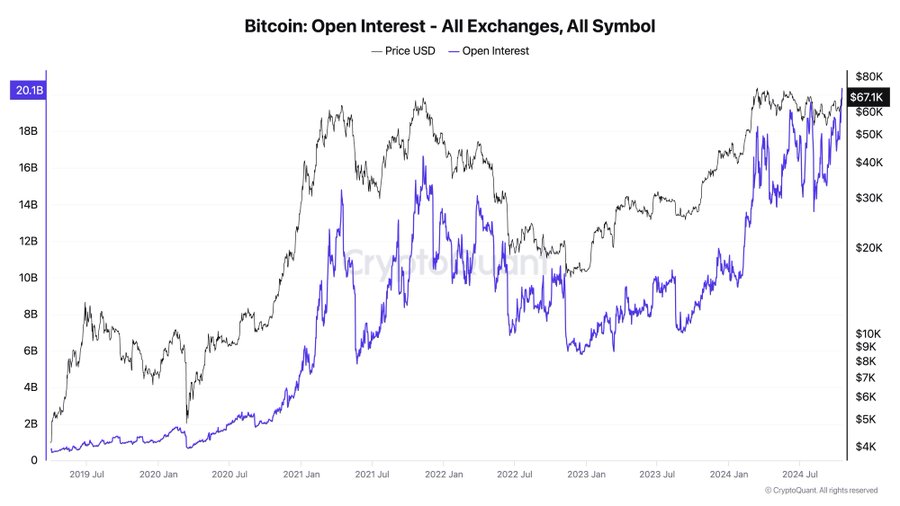

The surge in global money flow could also explain why BTC’s open interest recently reached a new all-time high (ATH) of $20 billion. This is bullish for the crypto as it attempts to surpass its current ATH of $73,000.

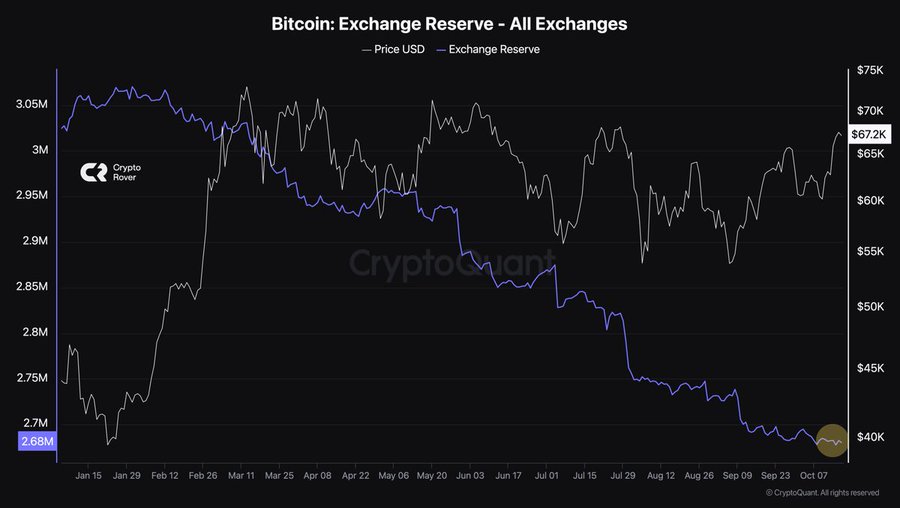

Crypto analyst Crypto Rover also recently shared CryptoQuant data, which showed that the BTC reserves on exchanges had hit a six-year low. This is significant as it shows there is currently a massive demand for the flagship crypto. Crypto Rover told market participants that they should get ready for an enormous supply shock.

There Is The Donald Trump Factor

The rise in the odds of Donald Trump winning the US elections is also believed to have contributed to the recent Bitcoin price rally. The latest Polymarket data shows that Trump’s odds of winning the elections are at 60.3%. As such, the market is already pricing into him being the next US President, as his win is bullish for BTC.

Trump has already declared his support for cryptocurrencies like Bitcoin, which is why he looks to be the most preferred among crypto voters. As part of the support for the former US President, Pro-Bitcoin PAC Bitcoin Voters recently unveiled their Donald Trump campaign ad.

Meanwhile, crypto research firm Matrixport has said that their $70,000 year-end Bitcoin price target is likely too “conservative” with Trump likely to win the elections. They noted how the former President’s policies in his previous administration favored BTC and predicted that something similar would happen again.

The crypto research firm also predicted more returns for the BTC price in the coming weeks, with Trunp’s odds of winning rising rapidly. According to trading firm QCP Capital, BTC is on the right path to hitting a new ATH. However, historical patterns in the last two US presidential election cycles suggest that a new ATH won’t come until January next year.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

1 month ago

34384

1 month ago

34384

English (US) ·

English (US) ·