ARTICLE AD BOX

Bloomberg analyst Eric Balchunas has weighed in on the ongoing debate surrounding Bitcoin’s lackluster price performance despite large inflows into Bitcoin ETFs. Balchunas argues that these ETFs are having a positive impact on Bitcoin’s value, even though the price has not soared as many expected.

Jim Bianco Raises Concerns Over Bitcoin’s Price Stability

In a series of posts on X (formerly Twitter), financial analyst Jim Bianco expressed his concerns about Bitcoin’s price stagnation despite record inflows into Bitcoin spot ETFs. Bianco noted that while Bitcoin has seen inflows exceeding $12 billion since its all-time high in March, the price remains down 4%.

He pointed out that, historically, factors like the recent halving, increased institutional involvement, and growing interest in digital assets should have driven Bitcoin’s price to new highs, yet the cryptocurrency has lagged behind traditional assets like gold, which is up 25% since March.

Bianco attributed Bitcoin’s limited price growth to the fact that much of the money flowing into ETFs may not be new capital. According to him, these inflows are largely coming from existing crypto holders moving funds from exchanges or personal wallets into ETFs rather than fresh investment.

He warned that this trend could have longer-term consequences for the crypto market, as money shifts from decentralized exchanges and wallets into traditional finance structures, potentially giving more control to institutions and regulators.

Bloomberg Analyst Argues Bitcoin ETFs Have Positive Effects

In response, Bloomberg analyst Eric Balchunas countered Bianco’s argument, stating that Bitcoin ETFs are already positively impacting the asset, even if the price growth isn’t as dramatic as some investors anticipated. Balchunas highlighted that Bitcoin has doubled in price since BlackRock’s ETF filing in early 2023, despite major market disruptions and “several significant dumps.”

He attributed some of Bitcoin’s resilience and current stability to the accessibility and low-cost structure of these ETFs, which provide a regulated gateway for investors previously hesitant about entering the crypto market.

Balchunas dismissed the notion that Bitcoin’s price should be significantly higher by now, noting that ETFs are powerful tools but don’t necessarily lead to instant price surges. He emphasized that the existence of brand-name ETFs like those from BlackRock could provide long-term benefits for Bitcoin’s mainstream adoption, even if short-term price movement remains subdued.

Cash-and-Carry Strategies Impacting Price Movement

Some analysts believe that trading strategies like cash-and-carry are also playing a role in limiting Bitcoin’s price growth. A cash-and-carry strategy involves buying Bitcoin in the spot market while simultaneously selling futures contracts, creating a delta-neutral position that captures the spread between spot and futures prices without exposure to price volatility.

This type of arbitrage allows traders to profit without influencing Bitcoin’s price, which may explain why significant ETF inflows have not translated into price gains.

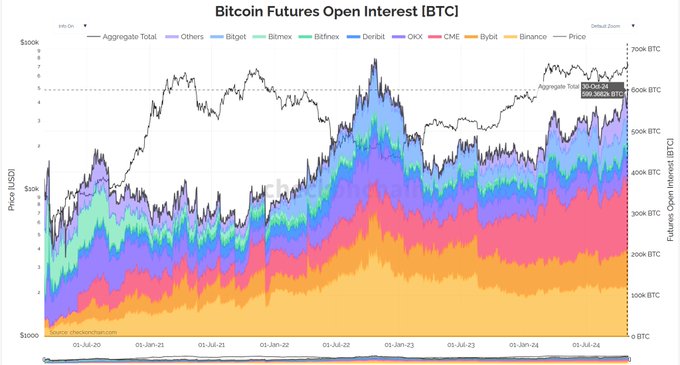

Analysts from Ryze Labs noted that institutional traders on platforms like the CME are actively using cash-and-carry strategies. These trades may be reducing upward pressure on Bitcoin’s price, as they keep capital tied up in low-risk positions rather than driving additional demand. This move has prompted the CME to be a major institutional platform for Bitcoin futures trading, with open interest at an all-time high.

Despite the current price stability, some experts believe that Bitcoin’s fundamentals remain strong, and the demand for the cryptocurrency could eventually overcome the stabilizing effects of cash-and-carry trades. “The long-term viability of Bitcoin is solid,” BlackRock CEO Larry Fink said recently, expressing his optimism about the asset’s future.

He indicated that as more investors turn to Bitcoin as a hedge against inflation and fiat currency devaluation, real demand might eventually outweigh the impact of arbitrage strategies, potentially leading to sustainable price growth.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor's degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

3 weeks ago

27936

3 weeks ago

27936

English (US) ·

English (US) ·