ARTICLE AD BOX

The crypto market remains on edge despite Bitcoin price noting a strong rally today. Notably, the recent transfers of more than 2500 BTC by Mt. Gox have sparked discussions among investors about how it could hinder the current rally of the coin. In addition, recent reports also indicate that BTC might witness a pullback ahead, citing historical and other market trends.

Bitcoin Price Faces Pullback Risk Amid Mt. Gox Transfer

According to a recent report by Arkham Intelligence, Mt. Gox has moved 2570 BTC today, valued at around $228.48 million. The transfer was made to a wallet “1PQZw…DDJtK”, sparking discussions about how it can impact the current rally of the Bitcoin price.

Besides, the bankrupt crypto exchange has also moved more than 32,300 BTC to two separate wallets recently. Despite that, the BTC still maintains its position in the green, indicating that investors are lauding the recent positive market trends in response to these short-term concerns.

However, if a similar selloff continues, it could significantly impact crypto’s performance in the coming days. Notably, the distribution of funds by Mt. Gox to its creditors has previously weighed on the investors’ sentiment. A flurry of traders fears the move will trigger selling pressure on the crypto if the creditors decide to liquidate their holdings.

On the other hand, other experts have remained confident. For context, given the growing appeal of crypto, especially Bitcoin, after Donald Trump’s win, many anticipate the creditors to hold on to their portfolio as the crypto continues to see new heights now.

Is BTC On the Verge Of A Pullback?

Amid the recent Mt. Gox transfer, many experts have warned about a potential pullback in the Bitcoin price ahead. However, as of writing, BTC price was up nearly 11% to $89,502.06, its new ATH, with its trading volume rocketing 77% to $136.35 billion. Furthermore, BTC Futures Open Interest rose 11%, reflecting the market’s strong confidence towards the crypto.

Notably, in a recent report, QCP Capital warns of potential pullbacks due to elevated perpetual funding rates and 7-month high basis yields. Despite structural bullishness, leveraged washouts may trigger corrections, the report noted. Besides, Veteran trader Peter Brandt echoes caution, citing Bitcoin’s inherent volatility.

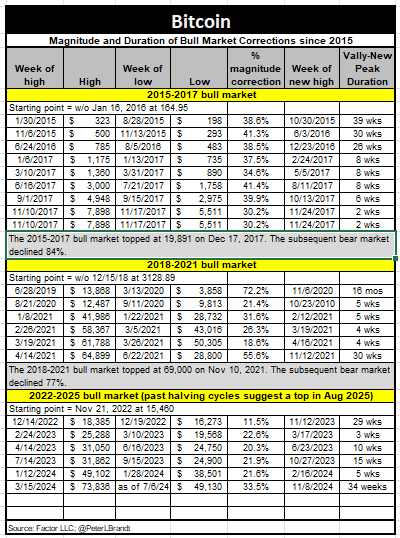

Brandt predicts Bitcoin will become the global standard of value, rendering other assets’ prices volatile. Historically, Bitcoin’s corrections have moderated since 2015. The latest bull cycle, starting November 2022, experienced mild corrections, including a 34-week, 33.5% downturn.

Source: Peter Brandt

Source: Peter BrandtHowever, it’s also worth noting that despite short-term correction concerns, many have remained bullish on BTC’s future trajectory. Recently, Peter Brandt said that Bitcoin price is likely to hit $200K in the coming days, echoing a similar outlook shared by the top investment firm Bernstein.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam's expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news. Rupam's career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

1 week ago

18575

1 week ago

18575

English (US) ·

English (US) ·