ARTICLE AD BOX

Moo Deng (Moodeng), the latest meme coin sensation based on Thailand’s pygmy hippo star of the same name, has begun its rapid descent. Yet, big-time token holders are still hoping for a rebound.

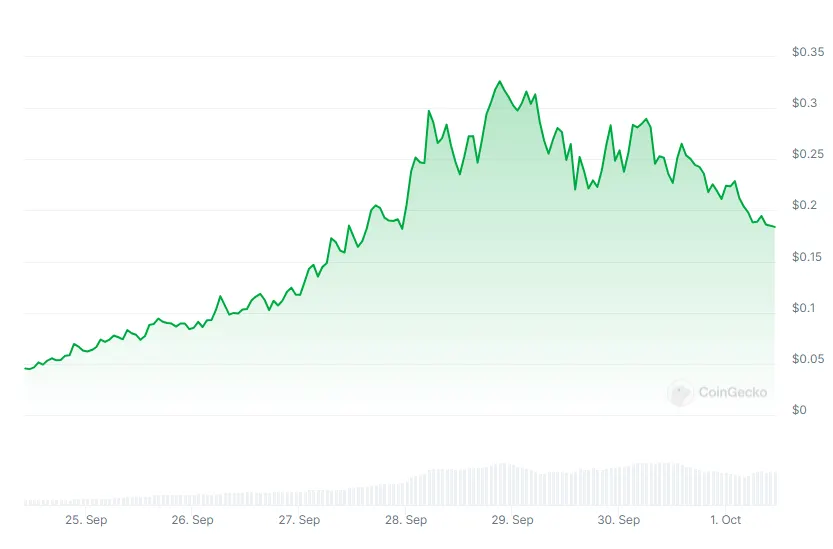

After reaching a market capitalization peak of $322.7 million on Sept. 28, Moodeng has fallen 50% to $0.18 in just three days, clocking a 26% drop in the last 24 hours alone.

One early buyer, known by his wallet address as “Trader Db3P,” bought $800 worth of Moodeng on Sept. 10—the day it launched.

A little over two weeks later, that investment had ballooned to a whopping $10 million. Despite the token's declining price recently, the trader appears to be holding fast even, as the coin plummets by roughly $1 million daily. His holdings are now worth half, still a hefty $5 million.

So why not cash out while he can?

Moodeng's price over the last seven days. Credit: CoinGecko

Moodeng's price over the last seven days. Credit: CoinGeckoThe coin’s rapid rise and subsequent crash are a perfect example of a fundamental issue in the memecoin space: liquidity.

With Moodeng's relatively small market cap, at $176.1 million, large bag holders who own significant amounts of the token face a challenge: All eyes are on Trader Db3P's wallet.

When he attempts to sell his holdings, it could trigger an even deeper crash, making it nearly impossible to exit without causing market chaos.

Liquidity problems often exacerbate volatility. Meme coins are especially susceptible to large price swings due to their small market sizes and speculative nature.

For Moodeng, where major holders control a large portion of the supply, this means even a single large sale could drastically affect prices.

As a result, the whales are opting to wait, holding onto their positions as they monitor the market or cash out in small batches for prolonged periods of time.

How to make Millions investing in Nothing

Moodeng's meteoric rise began on Sept. 19 when its namesake, a baby hippo at Thailand's Khao Kheow Open Zoo, became an Internet sensation. Millions of views later, the Solana-based token launched on Pump.fun two weeks prior suddenly found itself in the spotlight.

By Sept. 24, Moodeng's market cap hit $70 million, blowing past other meme coins on the platform. Its Twitter fanbase grew to 39,000 followers, outpacing the actual number of token holders.

Even still, the token's value kept climbing, surging 34% in a single day on Sept. 26. That 597% weekly gain pushed Moodeng to the top of the Pump.fun heap, with its market cap ballooning to $265 million.

All for yet another coin that had absolutely no utility.

Moodeng wasn't alone in this frenzy. Just as Dogwifhat and Pepe did a few months ago and Shiba Inu did a few years ago, this small coin pushed other tokens with it, from OG meme coins like Dogecoin to Iggy Azalea's MOTHER token and the Trump-inspired MAGA Coin.

Sept. 27 witnessed another 50% spike for Moo Deng, with the token reaching its all-time high of $0.41. That's when our mystery trader's $800 bet theoretically flirted with the $10 million price—and that’s the day the token started its slide to its current price.

Amid this meme coin mania, some voices raised concerns. The anonymous Moodeng whale faced insider trading accusations. Critics pointed to the token's massive gains and questioned the timing of the initial investment.

But is this truly a case of insider trading? At this point, who knows? A lot of these success stories (at least the legit ones) do tend to come from meme coin hunters—people waiting and buying every worthless token that appears, every airdrop, every time. And sometimes they get lucky.

For example, one Moo Deng trader turned $7,000 of Moodeng into $1 million after cashing out within two weeks after their initial buy. According to blockchain data, the trader now has 250 tokens left.

This type of decentralized lottery might make some sense for people who are willing to lose their money betting on the next meme coin sensation. But for the rest of us, it would be better to invest in a ticket to Thailand to see the real baby hippo.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

(1).png) 11 months ago

463443

11 months ago

463443

English (US) ·

English (US) ·