ARTICLE AD BOX

The Ethereum price has noted highly volatile trading lately, moving between the $2,600 and $2,300 range. However, amid this, a prominent crypto market has highlighted a key support level, falling below which could trigger a further selloff in the Ether market, potentially dragging its price down. In addition, a flurry of factors are also in the play, that could potentially influence the ETH price in the coming days.

Ethereum Price At Risk Of Further Decline

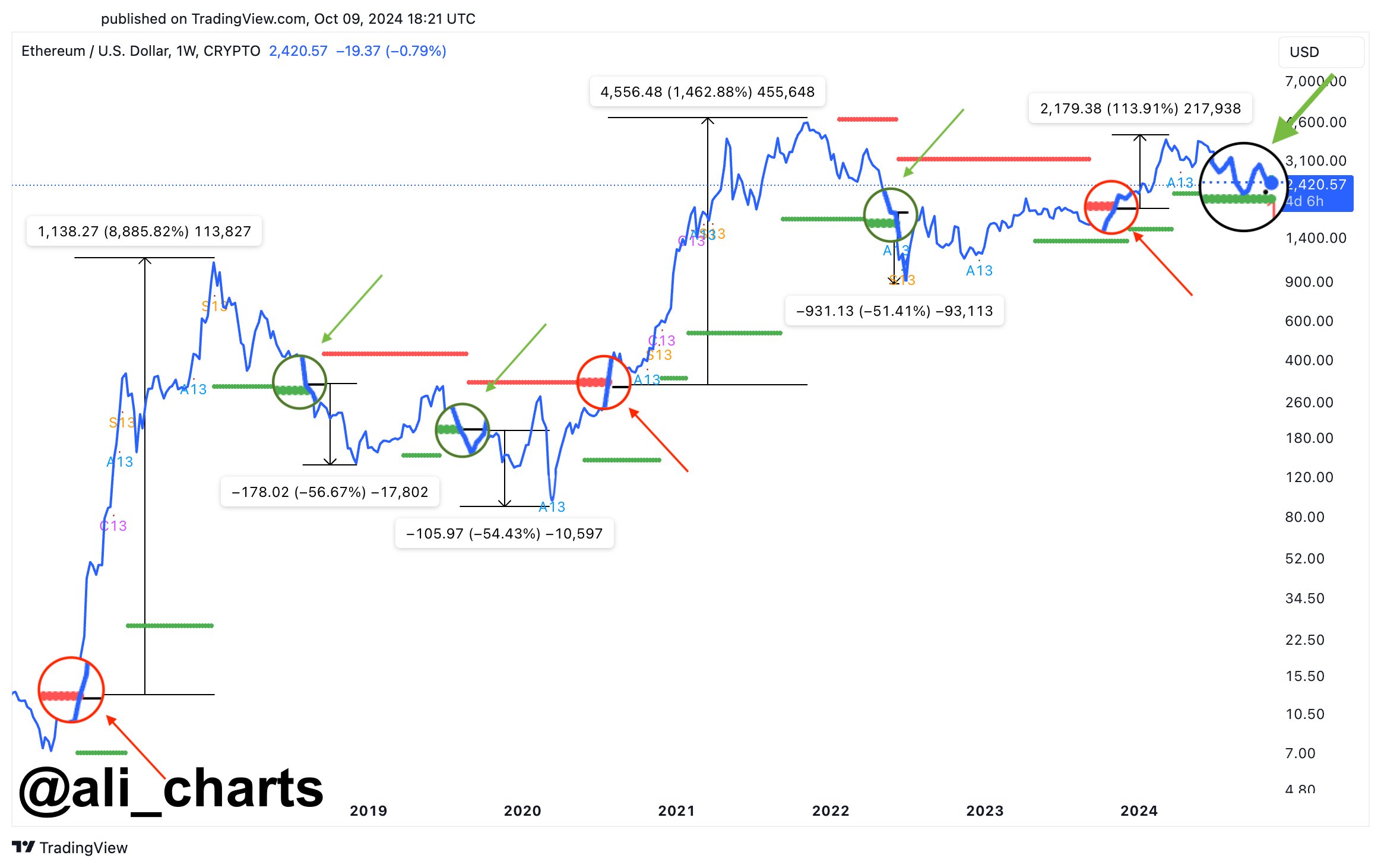

In a recent analysis, shared on the X platform, renowned crypto expert Ali Martinez identifies $2,300 as a crucial support level for the Ethereum price. He noted that more than 2.4 million addresses have purchased 5.6 million ETH at this level.

Source: Ali Martinez, X

Source: Ali Martinez, XHaving said that, he predicts that if Ether falls below this level, it could trigger a selloff, as investors might choose to minimize their losses. In other words, Martinez issued a stark warning that falling below the $2.3K level could lead to a further dip in ETH price.

In another analysis, Martinez said that Ether tends to see a strong correlation whenever it breaks below its TD setup support trendline. Considering the past patterns, the average of such drops is around 53%, which could cause trouble for the crypto. In that analysis, he noted that if the second largest crypto by market cap loses the $2,250 support, a significant price drop may follow.

Source: Ali Martinez, X

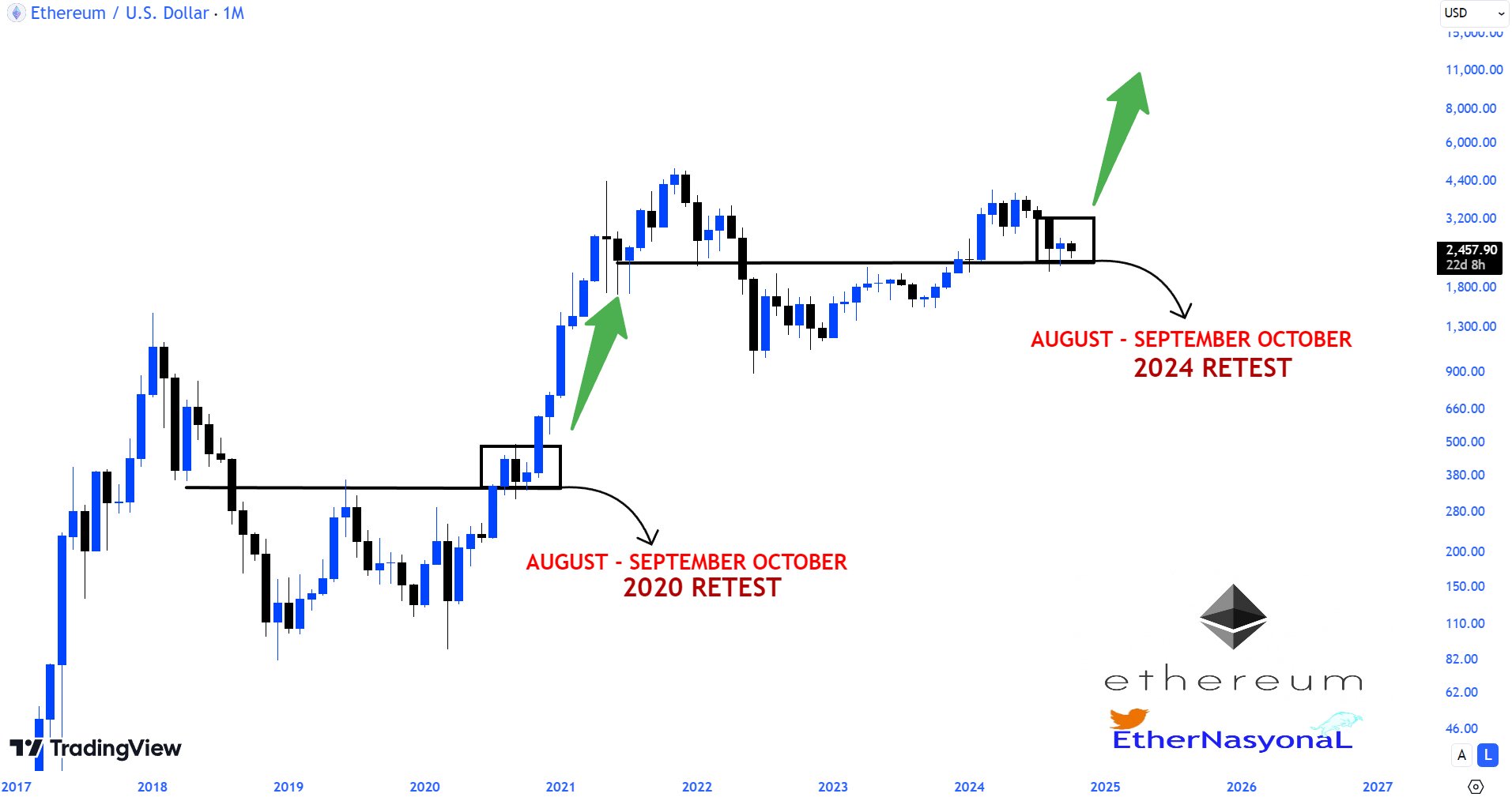

Source: Ali Martinez, XHowever, despite these, some analysts have remained bullish on the crypto’s long-term potential. A popular crypto analyst, known as EᴛʜᴇʀNᴀꜱʏᴏɴᴀL on X, said that Ethereum is now at the final stage of its accumulation process, readying for a major bull run in 2025. He has cited historical trends to support his comments.

Source: EᴛʜᴇʀNᴀꜱʏᴏɴᴀL, X

Source: EᴛʜᴇʀNᴀꜱʏᴏɴᴀL, XWhat’s Next For ETH Price?

The Ethereum price has been highly volatile over the past few days, as evidenced by its recent performance. In addition, the slowing US Spot Ether ETF inflows have also sparked concerns over the shifting interest of the market participants from ETH to other top altcoins.

However, despite that, many in the crypto market remained bullish on the second-largest crypto by market cap. Historical data indicates that the crypto market showcased a positive performance in the final quarter of the year. Besides, the upcoming US Presidential Election is also likely to boost the ETH price in the coming days.

Meanwhile, Standard Chartered’s Global Head of Digital Assets Research Geoff Kendrick has also shared a bullish sentiment recently. According to him, if Donald Trump wins and continues to maintain his pro-crypto stance, Solana price could see a 5X surge by 2025. Simultaneously, for Ether, he predicted a 4X jump, and a 3X surge for BTC, sparking market optimism.

In addition, an Ethereum price prediction hints at a potential ETH rally of around 11% by December this year. This has sparked both speculations and optimism among investors, especially as the market is keeping a close track of the crypto’s price.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam's expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news. Rupam's career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

1 month ago

31991

1 month ago

31991

English (US) ·

English (US) ·