ARTICLE AD BOX

The cryptocurrency market is currently facing turbulence following reports of a U.S. investigation into Tether, one of the market’s most crucial stablecoins.

As uncertainty continues to surround the case, the ripples of this investigation may be felt across the cryptosphere. The possible implications could redefine market directions, direct investor activities, and transform the flow of funds, while the industry continues to anticipate further developments.

WSJ Report and Tether’s Response

According to the WSJ, the US regulators are now probing Tether (USDT). This report has raised some concern among the market players and thus has raised a number of possibilities that could occur.

However, Tether’s CEO has come out to refute such claims and stated that no such investigation is ongoing at the moment. This has created more confusion and provided little relief to investors who are still in the dark trying to get more information.

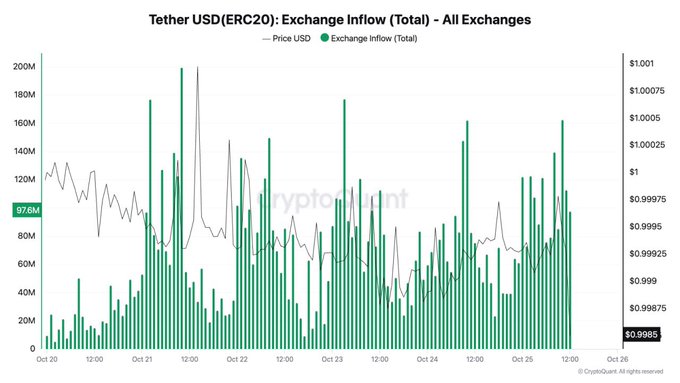

From the on-chain data, USDT injections to exchanges still hover around average levels, which indicates that traders have not started to move away from the stablecoin en masse. However, the price of USDT has slightly dropped, suggesting that some traders might be squaring off their positions due to the current news.

Tether’s Role in the Cryptocurrency Market

Tether (USDT) is a key player in the digital asset space, often serving as a bridge between traditional and crypto markets. Its value is pegged to fiat currencies, providing stability amidst crypto’s well-known volatility. Many investors and traders use USDT to move in and out of more volatile assets like Bitcoin and other altcoins, making it a preferred tool for maintaining liquidity.

However, any doubt in the stability of the stablecoin issuer can led to substantial market effects. The recent news regarding the U.S. investigation into Tether’s operations has also cast a shadow over the company’s reserve disclosures and its overall compliance status.

If this investigation brings out some ugly developments, then the use of USDT across the global exchanges may be affected, and this will affect the liquidity of the market as well as the flow of funds within the crypto market.

Potential Shifts in Investor Behavior

Investors have already raised concerns over the recent investigation of Tether. This has led to some short-term decline in the value of cryptocurrencies, as traders prepare for the worst. In the past, issues related to Tether have opened up more volatility but at the same time they have also led to steep market recoveries.

For instance, earlier cases of instability with regards to the issuer of stablecoin have been linked to sharp rises in the price of BTC. After the USDT-related issues in January 2019, Bitcoin increased by 268%, and a similar situation in December 2020 led to an increase in Bitcoin by 255%. More recently, in June 2023, another bout of Tether-related uncertainty preceded a 200% increase in Bitcoin’s value.

Some market analysts have pointed to this historical trend and suggested that doubts over Tether may yet once again presage a bullish turn in the market. If investors regain confidence, they may transfer their funds from the relatively stable USDT to riskier assets such as Bitcoin and altcoins, thereby causing the prices of these assets to rise.

Impact on USDT Dominance and Market Liquidity

The probe in the stablecoin issuer can also have an impact on the USDT market share, meaning the share of the stablecoin issuer’s market capitalization relative to other cryptocurrencies. Moreover, the USDT dominance has been on decline since March 2024 and the news of the investigation added more pressure down to this trend.

The decrease in USDT market share means that investors are more likely to venture into riskier assets than USDT, which could be BTC or other cryptocurrencies.

As the investors move out of USDT, the liquidity may be distributed among other cryptocurrencies leading to a diversified market situation. This change could increase the trading volumes of other digital assets and may just be a precursor to a broader market upswing. However, if the investigation leads to the restriction, or limited use of USDT, this may pose a problem to some exchanges and traders since they may not be able to easily meet their trading needs.

Broader Economic and Regulatory Repercussions

The implications of a U.S. investigation into Tether extend beyond the crypto market, potentially affecting broader financial stability. In several countries, particularly those with unstable banking systems, stablecoins like Tether have become a critical medium for transactions. Disruptions to USDT could push users back into less stable currencies, exacerbating financial challenges in these regions.

Moreover, regulatory scrutiny on the stablecoin issuer could prompt calls for greater transparency across the entire stablecoin sector. This could result in more rigorous oversight for other stablecoin issuers, aiming to ensure that their reserves are fully backed and verifiable. While tighter regulations might increase confidence among institutional investors, they could also limit the flexibility and innovation that has characterized the crypto market.

At the same time, scrutiny of centralized stablecoins like Tether could encourage interest in decentralized finance (DeFi) solutions. Decentralized stablecoins, designed to operate without a central issuer, might see increased adoption as investors seek alternatives that offer greater transparency.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor's degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

1 month ago

31081

1 month ago

31081

English (US) ·

English (US) ·