ARTICLE AD BOX

Today, enjoy the On the Margin newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the On the Margin newsletter.

Welcome to the On the Margin Newsletter, brought to you by Ben Strack, Casey Wagner and Felix Jauvin. Here’s what you’ll find in today’s edition:

- With the next FOMC meeting a month away, Felix breaks down the potential size of the anticipated rate cut.

- Democrats hoping to appeal to the crypto industry say they can get legislation passed by the end of the year.

- There’s a new risky investment vehicle. Ben has all the details.

Growth scare over?

Last week, the financial world was very different. You had people on TV yelling about how the Fed needed to do an intermeeting rate cut and that a recession was all but guaranteed if they didn’t cut right here, right now.

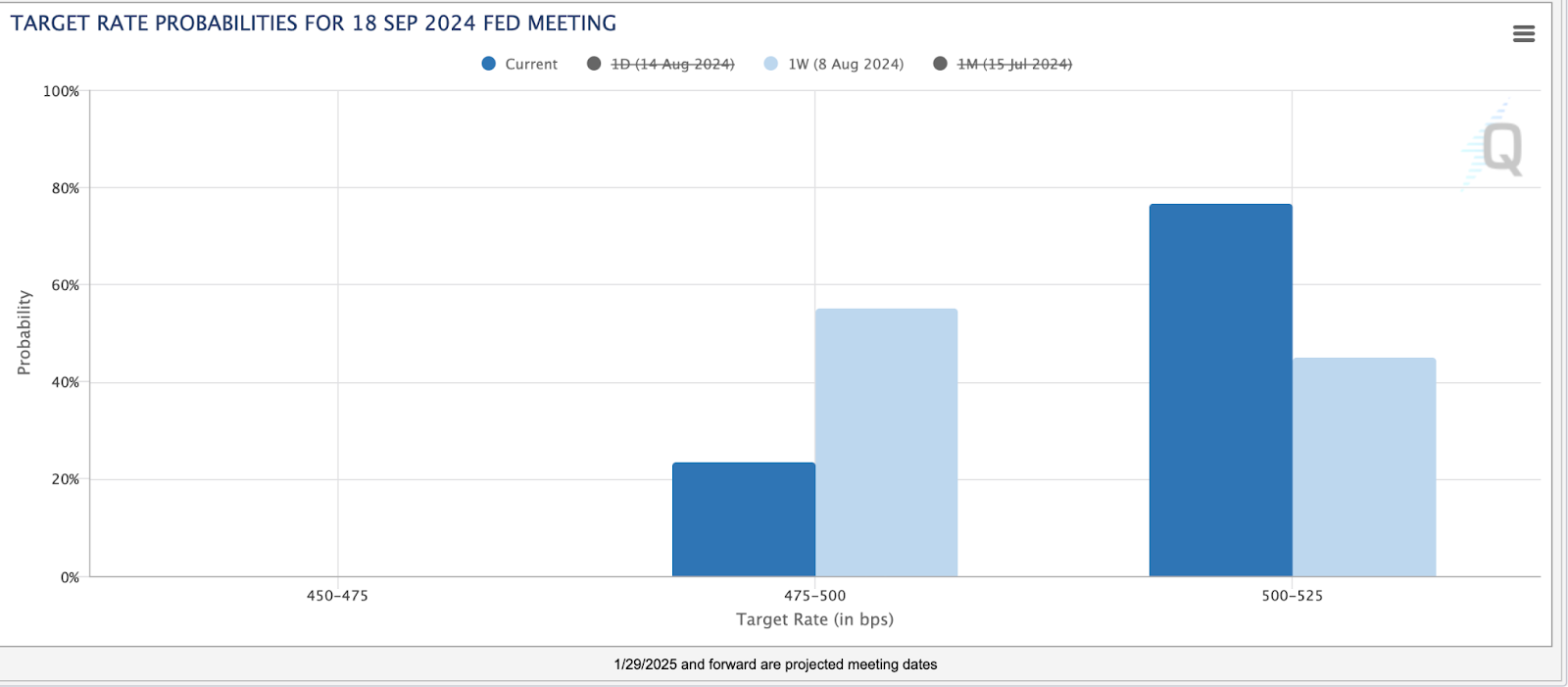

Fed funds futures on Aug. 8 were pricing in a higher probability of a cut of 50 basis points versus a 25 bps cut.

We are now in better balance — with a 73% chance of a 25 bps cut and a 26% chance of a 50 bps cut. So what exactly happened between then and now, and where does that leave us?

As discussed in the Aug. 6 newsletter, we saw the third-highest VIX print of all time and a ton of idiosyncratic market structure events unfold.

The big story, however, was that very little of this had any contagion into the market components the Fed really cares about (credit spreads, Treasury market liquidity, money markets). And so, just as quickly as VIX spiked to 65, we were back down below 20 again.

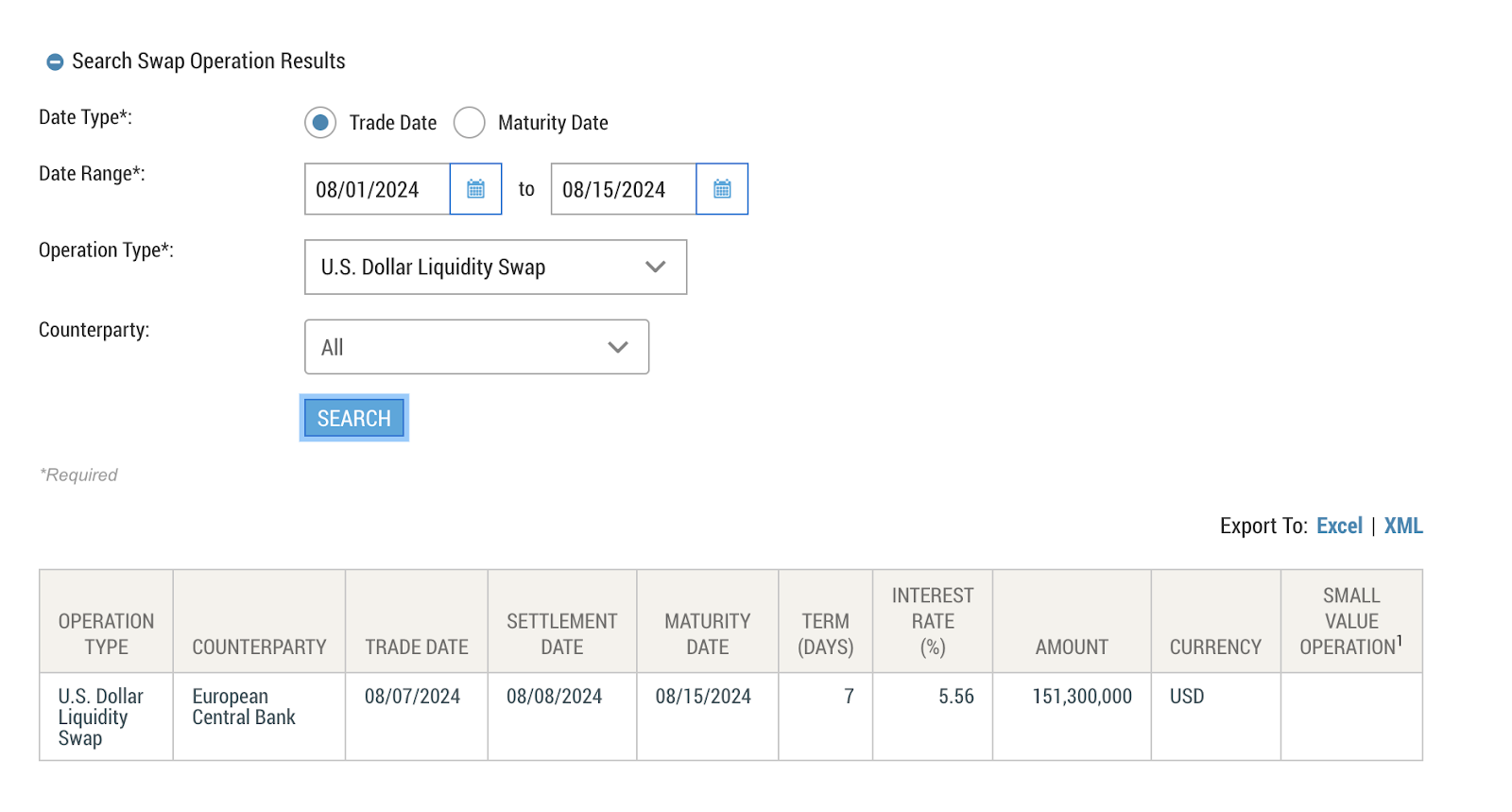

During that time, the Fed did nothing, and FOMC members hardly mentioned the volatility crash in their press appearances. Further, we saw no uptake in the Fed-Bank of Japan swap lines, which implies there wasn’t a dash for cash during the yen carry trade unwind:

This entire excursion that markets went through in the past week is increasingly looking like the climax of what was a growth scare, but not a recession. And certainly nothing that warranted a 65 VIX handle. As we continue to receive new economic data, it’s becoming even more evident that this growth scare could be over.

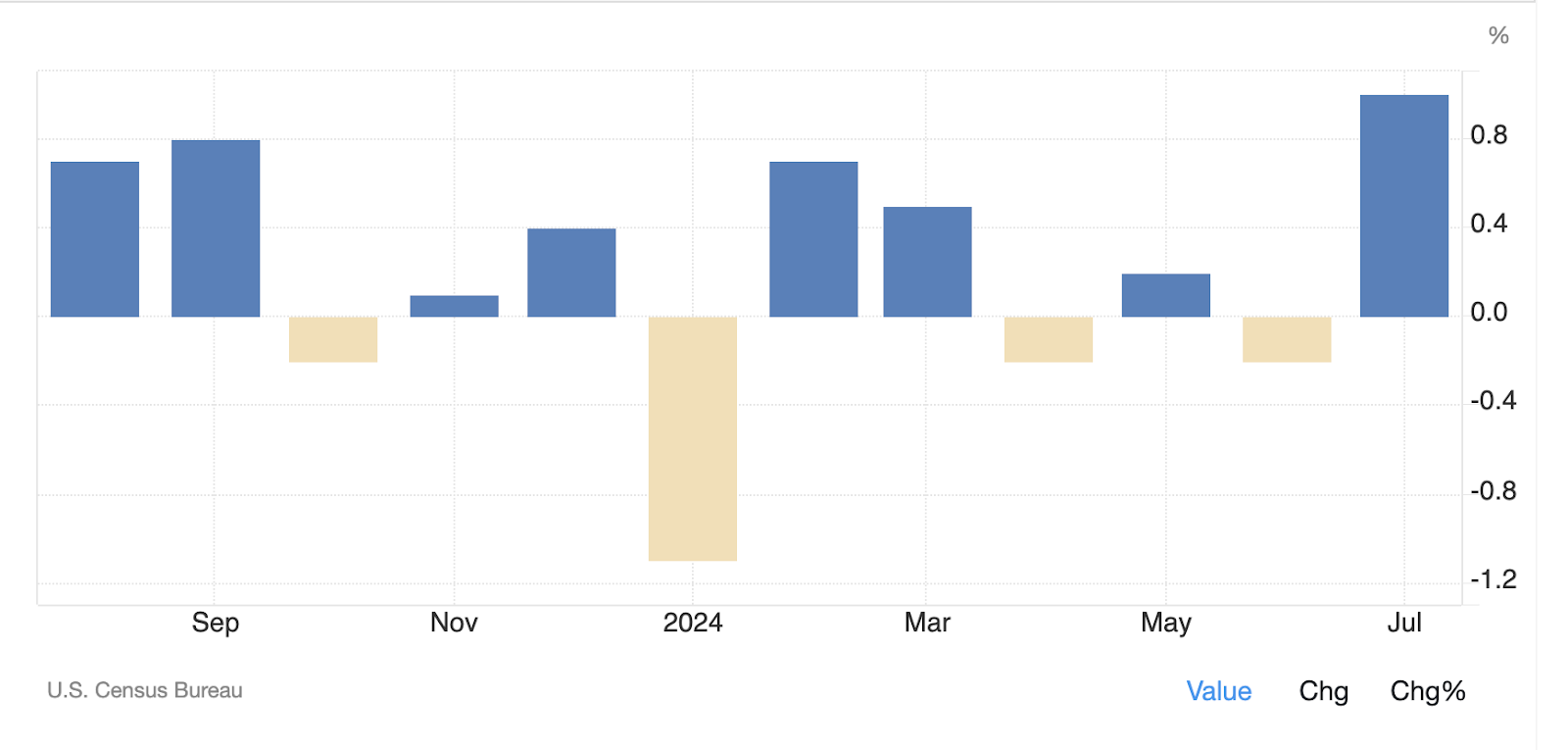

We registered a 1% month-over-month increase in US retail sales today — the highest print since January 2023 and significantly above the forecasted 0.3% increase:

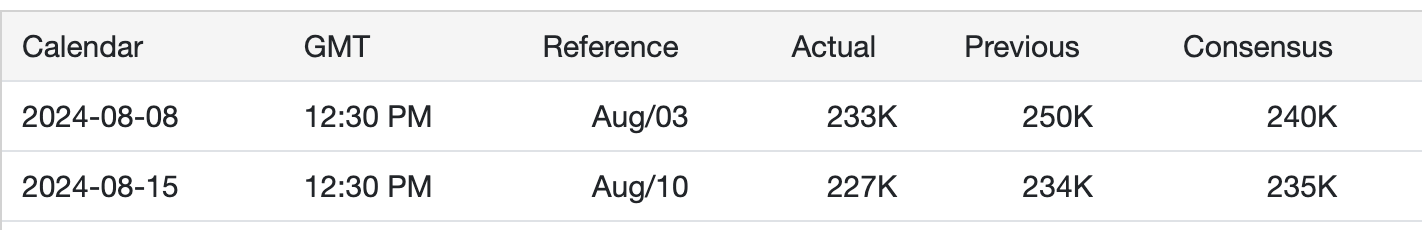

Further, we have seen two weeks in a row of lower-than-expected initial jobless claims, which hints a lot of the labor market loosening this past month was both seasonal and temporary due to Hurricane Beryl:

What these data points tell me is that the consumer is still spending and the labor market is in an equilibrium state — but not exactly weak.

This data sets the stage for a tight-lipped 25 bps cut in September, as opposed to the panicky and recessionary 50 bps cut that was the base case priced in last week.

To be clear, I see a 25 bps cut as a normalization cut that the market would take as bullish. But a 50 bps+ cut could be interpreted as bearish due to the implied panic baked into the move. As discussed in the July 9 newsletter, knowing what type of cut we are seeing is key to understanding how markets will react to them.

— Felix Jauvin

$63 million

The amount of collateral euro-pegged stablecoin issuer Anchored Coins should have. At least some of these reserves were held at the now-bankrupt Swiss bank FlowBank, Anchored Coins said in a statement. That could pose a problem for holders looking to redeem their tokens.

“A risk remains that in case of a shortfall, the 1:1 redeemability cannot be upheld, which would lead to a respective loss for the holders of AEUR tokens,” Anchored Coins noted.

Any losses would be “applied proportionately” across all token holders, the company added, per Swiss regulatory guidelines.

Crypto4Harris has the ‘crypto,’ not the ‘Harris’

Republicans aren’t the only ones who can get sensible crypto policy passed, Senate Majority Leader Chuck Schumer said Wednesday evening during the inaugural event for the grassroots “Crypto4Harris” group.

In fact, Schumer is confident he can get “something passed out of the Senate” by the end of the year. While he didn’t specify which bill he thinks can make it through a floor vote, insiders say he’s talking about a bill from Sen. Debbie Stabenow, who also joined Wednesday’s call.

Stabenow in July teased a new crypto bill during a Senate Agriculture Committee meeting. (I know, why is Ag talking about crypto? They actually handle a lot of financial issues.) The Michigan Democrat unveiled the Digital Commodities Consumer Protection Act (DCCPA) last session, though that never made it to a vote.

The DCCPA focused on giving the CFTC more power over the digital asset industry, an effort largely supported by crypto folks. Members of the DeFi community however criticized the bill, given it would require decentralized protocols to follow the same guidelines as centralized intermediaries.

Stabenow has not yet introduced a new version of the DCCPA, but I’m hearing she’s working on it. Remember, she’s retiring at the end of the year — so if she wants this to move, she better act fast. Her office did not immediately respond to our request for comment.

Stabenow’s original bill did have some bipartisan support, with Republican Senators John Boozman, John Thune and Joni Ernst signing on as co-sponsors. Republican Rep. Patrick McHenry expressed interest in helping Schumer get crypto policy over the finish line; but McHenry’s term ends in 2025, and he is not seeking reelection.

Harris’s team has no public involvement in the Crypto4Harris group, and no one from her campaign participated in Wednesday’s call.

— Casey Wagner

MSTR exposure, in a leveraged ETF…

We talk plenty about crypto market volatility (just look at last week). We also regularly write about the segment’s growing ETF universe.

Speaking of volatility and ETFs, investors can now own a fund giving them leveraged exposure to the largest corporate holder of bitcoin: MicroStrategy.

As a reminder, Michael Saylor-founded MicroStrategy is that company with a software business that also buys and holds a ton of bitcoin (currently 226,500 BTC). A number of investors have historically used MSTR as a bitcoin proxy, particularly before spot bitcoin ETFs hit the US market in January.

Now, Defiance ETFs’ Daily Target 1.75X Long MSTR ETF seeks daily leveraged investment results of 175% the daily percentage change in MicroStrategy’s share price.

“The fund is not suitable for all investors,” Defiance warns in a disclosure.

No kidding.

Who is it for then? Most likely arbitrageurs and crypto day traders, according to Bryan Armour, a director of passive strategies research at Morningstar.

MSTR shares were up 95% year to date, as of 2 pm ET — better than BTC’s 32% gain over that span. Saylor has touted the benefits MSTR shares have over spot bitcoin ETFs, notably its lack of a fee and “intelligent leverage.”

So now we’re talking leverage on leverage.

Almost all investors should avoid this ETF because of its high fee (1.29%) and difficulty valuing the strategy, Armour argued.

“Volatility decay eats away at long-term returns such that even a sideways market for MSTR could result in substantial losses for the ETF over the long term,” he told Blockworks.

The fund comes seven months after BlackRock, Fidelity and a slew of other issues debuted spot bitcoin ETFs in the US. That category’s funds have so far tallied $17.3 billion of net inflows.

A leveraged bitcoin ETF by Volatility Shares, which holds BTC futures contracts, has $1.4 billion in assets under management — proving some demand for amplified bitcoin exposure.

“Crypto traders seem to love volatility and upside,” Armour said. “I just wonder why bitcoin investors would prefer this [MSTR fund] to buying unleveraged bitcoin exposure either directly or via ETFs.”

— Ben Strack

Bulletin Board

- Morgan Stanley revealed in a Wednesday filing that it owned 5.5 million shares of BlackRock’s iShares Bitcoin Trust (worth roughly $187 million) in Q2. Among institutions that reported bitcoin ETF holdings in Q1 via 13F filings, 44% upped their positions, Bitwise’s Matt Hougan said in an X post. As for the others, 22% held steady, 21% decreased and 13% ceased the allocations, he added. For more on what to make of the 13Fs, read what Blockworks’ Katherine Ross had to say.

- While Vice President Kamala Harris has not yet shared many details about her platform, she is set to outline some of her economic agenda during a Friday speech in North Carolina, the New York Times reported Thursday. With the Democratic National Convention starting Monday, Harris is the party’s presumed nominee to face off against Donald Trump in November.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

(1).png)

1 year ago

496870

1 year ago

496870

English (US) ·

English (US) ·