ARTICLE AD BOX

The PEPE coin has fallen by 0.335 in the last 7 days. The notable gain of more than 40% in the last 7 days is what’s catching the community’s attention. To be more specific, the frog-themed meme coin has increased by 40.40% in the last 7 days and is hovering around $0.00001131 at the time of writing this article. This has caught everyone’s attention because it signals a step away from being influenced by the price movements of Bitcoin ($BTC).

BTC is only up 1.13% in a week’s timeline, for an approximate value of $63,971.80 right now. The crypto market is known to follow the trail that the likes of BTC and ETH set. PEPE has broken that trail to carve its own path. This has placed PEPE in the top three altcoins to be considered. This could be due to its potential for portfolio diversification or yield generation. Needless to say, it is important to do research and self-risk assessment before following through on any trend in the crypto market.

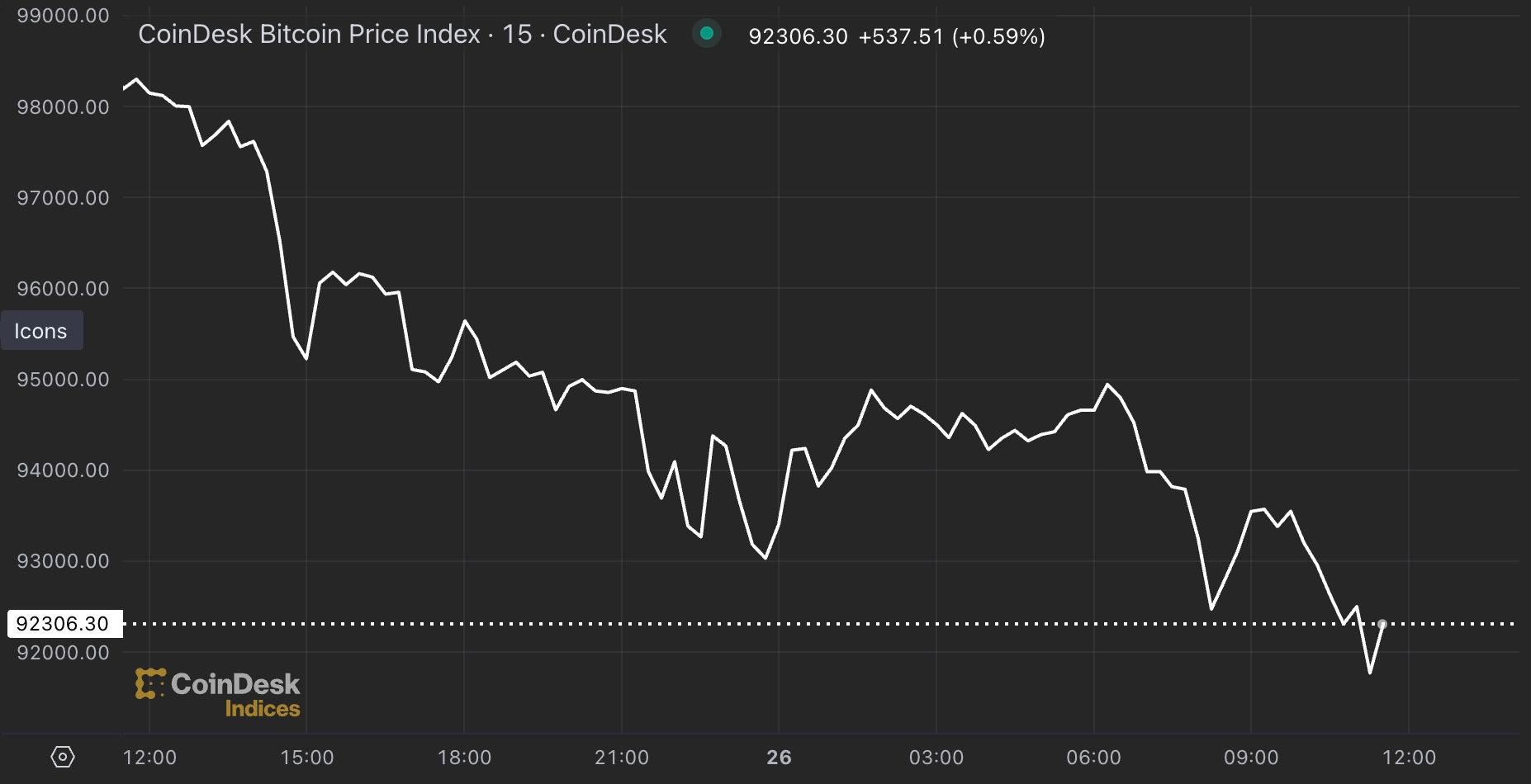

The value of Bitcoin tokens has significantly decreased from their peak of $66,397.18. They are still far from reaching their previous highs. It does not negate the fact that BTC has a larger potential to make significant gains at any moment. Recent rate cuts by the Federal Reserve have made this evident with a surge in the values.

PEPE, on the other hand, is inching closer to the weekly high of $0.00001188 with green trades to its corner. It is speculated that it will cross the $0.000015 mark by the end of October. The PEPE crypto prediction supports this speculation by estimating a move to $0.000029 by the end of this year. It could alternatively land at $0.000020. Near-term predictions are more optimistic. They forecast a 231.24% surge in the next 30 days for a value of $0.00003496. It will interestingly build on a jump of 30.62%, which could happen in the next 5 days.

As attractive as they sound, near-term predictions bring a chance of high volatility. The ongoing level is at 15.36%, which is considerably high. In the last 30 days, sentiments have been bullish, with an FGI of 50 points and green days of 63%.

The majority of the technical indicators signal the option to buy PEPE. This includes Daily SMA 100 and Daily EMA 200. The 14-day RSI of 77.07 indicates a decision to sell rather than hold on to it. The trend has breached the resistance trendline of a falling wedge pattern, which drove a steady correction for 4 months. This breakout and expected highs in the times to come cement the fact that the correction phase is done & dusted.

Bitcoin’s dip away from $65,000 has had an impact, but several lower-ranked tokens have managed to soar in this situation. The influence exists, and chances are it is on the verge of diminishing, especially with more cryptos aiming to have their respective ETFs float in the market.

(1).png) 1 month ago

30274

1 month ago

30274

English (US) ·

English (US) ·