ARTICLE AD BOX

Veteran trader and market expert Peter Brandt has sparked discussions in the broader crypto market, anticipating a potential Bitcoin selloff in the coming days. This comment comes as BTC continued to flirt near the $100K mark in recent days, indicating a strong market confidence towards the crypto. However, despite revealing this cautious sentiment, Brandt appears to remain optimistic about BTC’s future trajectory.

Peter Brandt Predicts Potential Bitcoin Selloff Ahead

As Bitcoin continued to hover near the $100K mark, reaching its ATH, some investors remain cautious anticipating a potential selloff. For context, as the price continued to rally, some investors might book profit by selling the crypto, with many experts hinting towards a potential pullback amid the bull run.

Amid this, veteran trader Peter Brandt has caught the eyes of investors with his recent comments. In a recent X post, Brandt said that there is a “possibility” that the bulls will dump their BTC holdings as it flirts near the $100K mark. He noted that the selloff would come as the investors might try to reenter the Bitcoin market at a lower price after the selloff, which would help them to book more profits.

However, he also affirmed that despite investors’ anticipation of a “correction”, it will “not come”, highlighting the crypto’s potential. In addition, he also predicted that the crypto might hit $120K, saying that the price is not likely to “come down”.

Looking at the recent comments of Brandt, it appears that the expert remains optimistic about Bitcoin’s future trajectory. Besides, it also comes after the expert has recently said that BTC is poised to hit $327K in the near future, sparking further optimism in the market.

Is BTC Selloff Imminent?

A flurry of experts has predicted that a potential BTC selloff is incoming, sparking market discussions, especially after Peter Brandt’s comment. In other words, the profit booking strategy of the investors might cause a slight pullback in the BTC’s current rally, as per the experts.

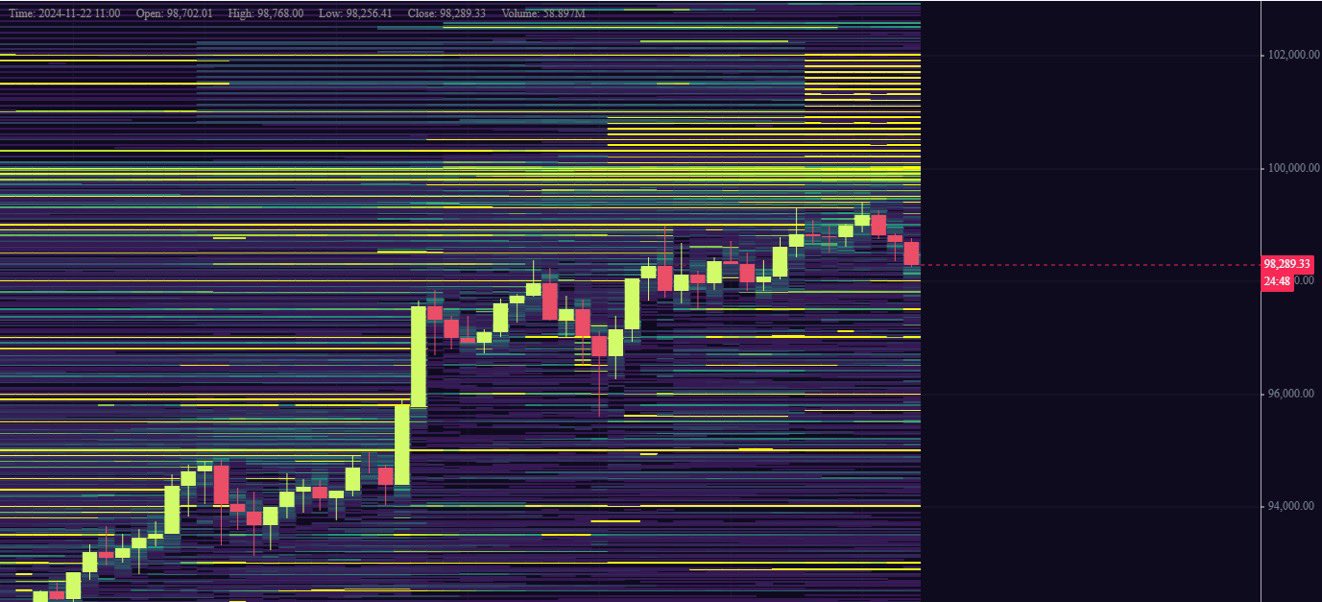

For context, in a recent X post, popular crypto market expert Crypto Rover said that a “huge sell wall” awaits at a $100K target for BTC. It indicates that the investors might sell their holdings if Bitcoin reaches this major target ahead.

In addition, another crypto market expert, Ali Martinez also echoed a similar sentiment like Peter Brandt and Crypto Rover recently. Martinez said that the flagship crypto is likely to face $1.89 billion liquidation if it reaches the $100,625 level, sparking further concerns in the market.

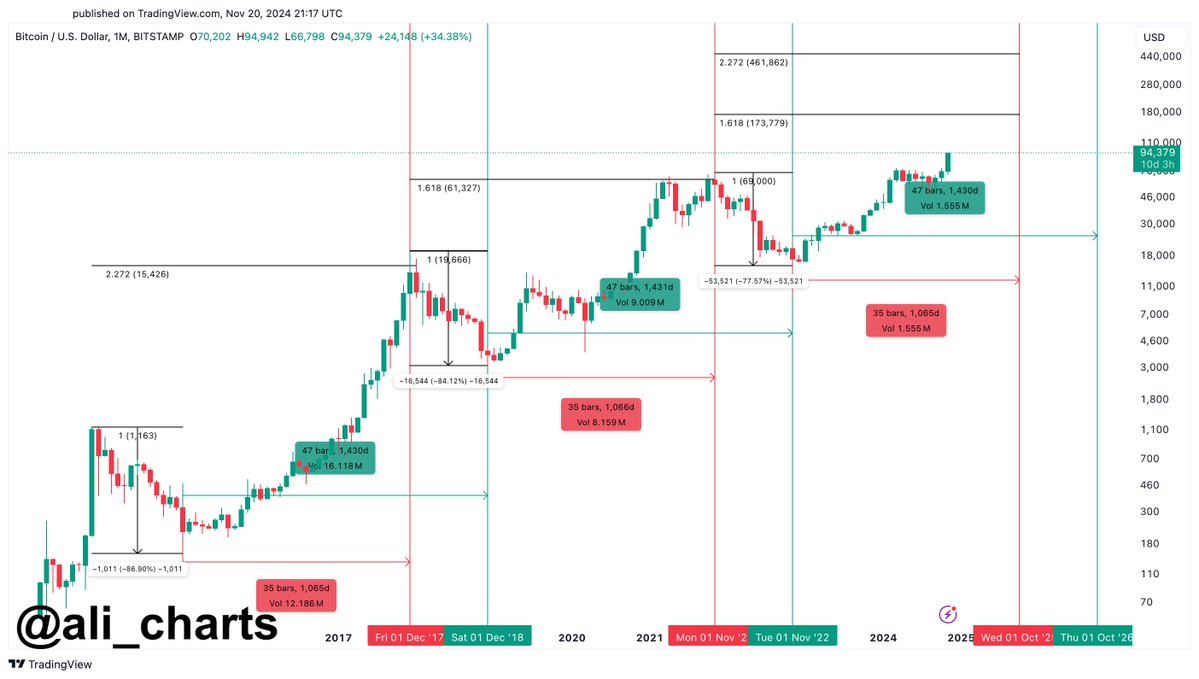

However, despite concerns over the selloff, which might trigger a slight pullback ahead, the experts have remained optimistic about the long-term trajectory. For context, in a separate post, Martinez cited historical trends, saying that Bitcoin is likely to peak between $173K and $461K by October 2025.

BTC price today has noted a slight decline and exchanged hands at $98,614, while its trading volume fell 29% to $68 billion. However, the crypto has touched a 24-hour high of $99,655 recently, marking its new ATH. However, derivatives data by CoinGlass showed that BTC Futures Open Interest declined by nearly 2% in the 24-hour timeframe, indicating that the investors are taking a pause amid the recent robust rally.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam's expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news. Rupam's career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

2 hours ago

213

2 hours ago

213

English (US) ·

English (US) ·