ARTICLE AD BOX

Rich Dad Poor Dad author Robert Kiyosaki has once again sparked discussions in the broader financial market with his recent X post. In his social media post, the renowned author predicted a potential financial market crash, which weighed on the traders’ sentiment amid the recent market selloff. Besides, he also urged investors to shift focus from traditional assets like stocks, bonds, etc. to risk-bet assets like Bitcoin, gold, and others.

Robert Kiyosaki Urges Caution For Boomers

In a recent post on X, Kiyosaki expressed his concern about the financial vulnerability of baby “boomers” as market conditions evolve. He argued that past trends like the real estate boom in the 1970s and stock market gains fueled by 401(k) plans have set unrealistic expectations. “When the stock market bursts, boomers will be the biggest losers,” he warned, emphasizing the need for a drastic financial shift.

In addition, Kiyosaki urged younger generations to advise their parents to sell high-value assets, such as real estate and stocks, while prices remain favorable. He predicted these markets would soon face significant downturns. “The biggest crash in history is coming. Please be proactive and get rich before boomers go bust,” he said urging investors to buy Bitcoin, gold, and silver. This comment, amid the recent crypto market crash, highlights his trust in Bitcoin as a hedge against the anticipated collapse.

Meanwhile, this isn’t the first time Kiyosaki has championed alternative investments. He has consistently advocated for Bitcoin, highlighting its potential to weather macroeconomic hurdles. However, his latest advice arrives amid increased volatility, with a $1.7 billion crypto market liquidation wave sparking concerns about broader market fragility.

A Closer Look Into The Stock Market

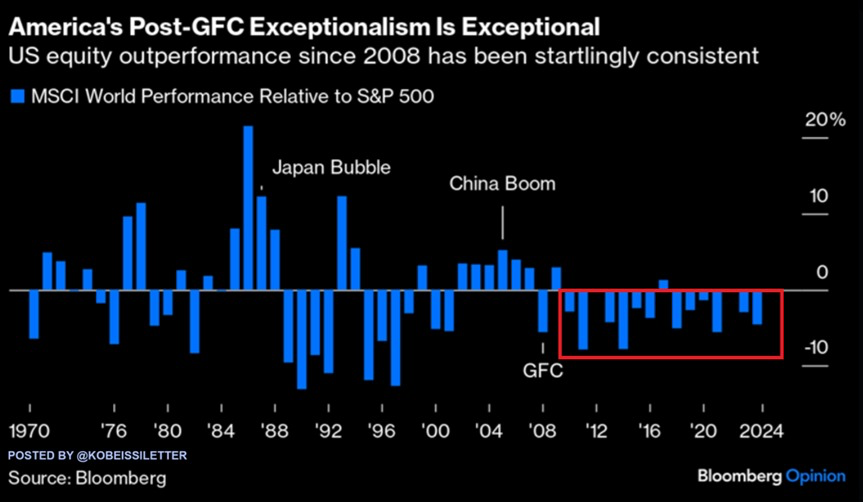

Kiyosaki’s dire forecast contrasts sharply with the current performance of the U.S. stock market. According to The Kobeissi Letter, the S&P 500 is on track for a historic 14th year of outperforming global markets. The index has risen 446% since 2009, far surpassing the 229% gain of the MSCI World Index.

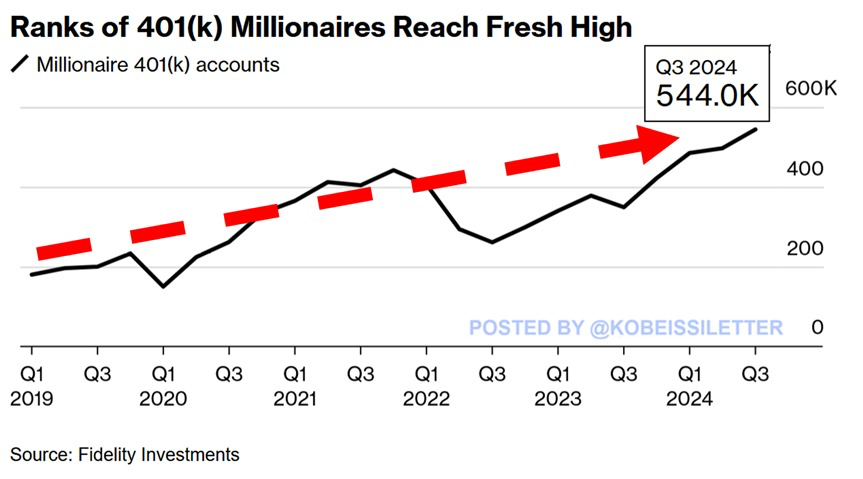

Additionally, U.S. retirement savings accounts have flourished. The number of 401(k) millionaires reached 544,000 in Q3 2024, a 56% increase from the previous year. Despite this, nearly 40% of workers lack access to retirement savings plans, highlighting a growing wealth divide.

However, Kiyosaki’s outlook challenges the optimism surrounding these gains. He believes traditional assets are unsustainable in the long term and warns of devastating consequences if investors fail to diversify. His focus on Bitcoin, along with other hard assets like gold and silver, reflects his belief in their enduring value amid economic turmoil.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam's expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news. Rupam's career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

8 months ago

407567

8 months ago

407567

English (US) ·

English (US) ·