ARTICLE AD BOX

Tesla holds firm on Bitcoin despite wallet shuffle – Arkham Intelligence Oluwapelumi Adejumo · 51 seconds ago · 2 min read

Tesla holds firm on Bitcoin despite wallet shuffle – Arkham Intelligence Oluwapelumi Adejumo · 51 seconds ago · 2 min read

Arkham suggested that the Tesla's recent Bitcoin movement might be geared towards obtaining a Bitcoin-backed loan.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Tesla maintains its remaining Bitcoin holdings despite recent wallet transfers that triggered speculation of a potential sell-off, according to blockchain analytics platform Arkham Intelligence.

In an Oct. 23 post on X (formerly Twitter), Arkham Intelligence clarified:

“We believe that the Tesla wallet movements that we reported on last week were wallet rotations with the Bitcoin still owned by Tesla.”

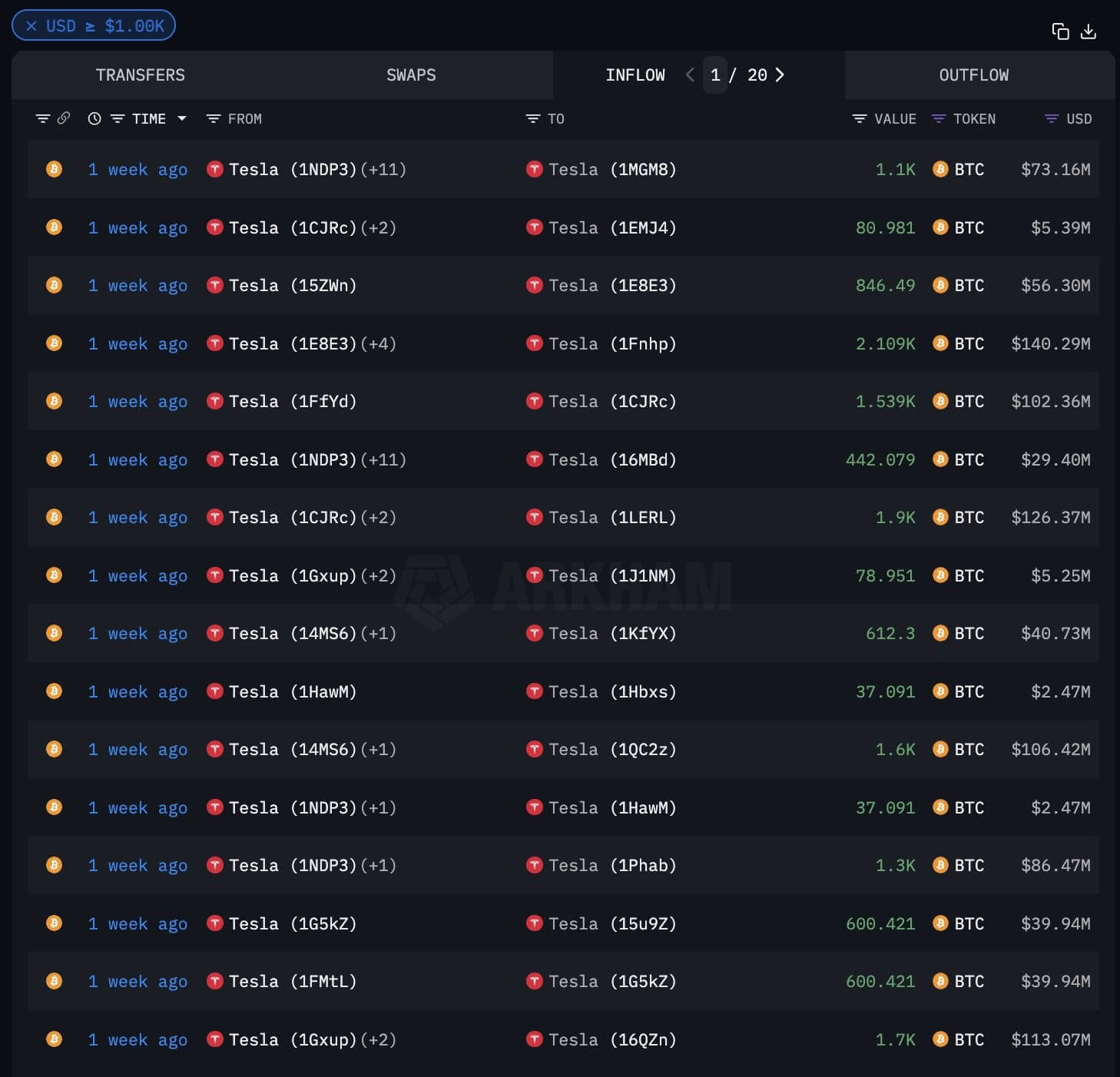

Arkham noted that the transfer involved sending Bitcoin to seven different wallets, each containing between 1,100 and 2,200 BTC. Prior to the final transfer, test transactions were conducted on all wallets, and all but one now hold round-numbered Bitcoin balances.

On-chain data shows that five wallets contain Bitcoin valued at over $100 million each—specifically, $142 million, $128 million, $121 million, $114 million, and $107.8 million. The remaining two wallets hold $87.6 million and $74.1 million, respectively.

Tesla Bitcoin Transfers (Source: Arkham Intelligence)

Tesla Bitcoin Transfers (Source: Arkham Intelligence)This update follows Tesla’s unexpected transfer of its remaining 11,509 BTC—valued at around $768 million at the time—last week. The move sparked rumors of a potential sale, as Tesla had previously liquidated Bitcoin holdings.

In February 2021, the company sold 4,320 BTC shortly after investing $1.5 billion to assess its market liquidity. Tesla executed another major sale in June 2022, offloading 29,160 BTC.

Since then, however, the company has maintained its Bitcoin holdings. Arkham Intelligence speculated that the recent transfers might be related to a Bitcoin-backed loan. It stated:

“Some have speculated that this is movement to a custodian, for example to secure a loan against the BTC.”

As of press time, Tesla has not issued an official explanation for the transfers. Nevertheless, the fact that Bitcoin remains untouched in the new wallets has alleviated immediate concerns about a market sell-off.

Market analysts are now looking to Tesla’s upcoming Q3 earnings report for further insight into the company’s recent actions.

English (US) ·

English (US) ·