ARTICLE AD BOX

TLDR:

- US Bitcoin ETFs saw $541.1M outflow on Nov 4, second-largest daily outflow in history

- Only BlackRock’s IBIT showed positive inflow ($38.4M)

- Fidelity fund had largest outflow ($169.6M), followed by ARK 21Shares ($138.3M)

- Outflows coincided with Bitcoin price drop below $70,000

- Market movement comes ahead of US presidential election and Fed meeting

United States Bitcoin exchange-traded funds (ETFs) experienced their second-largest daily outflow on November 4, 2024, with investors withdrawing $541.1 million just one day before the presidential election. This massive movement of funds represents a clear shift in investor sentiment as markets prepare for potential political changes.

The withdrawal falls just short of the previous record set on May 1, when outflows reached $563.7 million following a 10.7% drop in Bitcoin’s price to $60,000. This recent outflow breaks a streak of seven consecutive trading days of positive inflows for Bitcoin ETFs.

Among the 11 spot Bitcoin ETFs, Fidelity’s Wise Origin Bitcoin Fund recorded the largest single-day outflow at $169.6 million. ARK 21Shares Bitcoin ETF followed with $138.3 million in outflows, marking its largest withdrawal since its launch.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) stood out as the only fund to attract new investment, securing $38.4 million in inflows. This represents a notable contrast to the broader market movement and suggests varying investor strategies across different fund providers.

Grayscale’s two Bitcoin funds experienced combined outflows of $153.2 million. The Grayscale Bitcoin Trust (GBTC) saw $63.7 million in outflows, while its mini GBTC recorded $89.5 million in withdrawals, representing the fifth and third largest outflows for the day respectively.

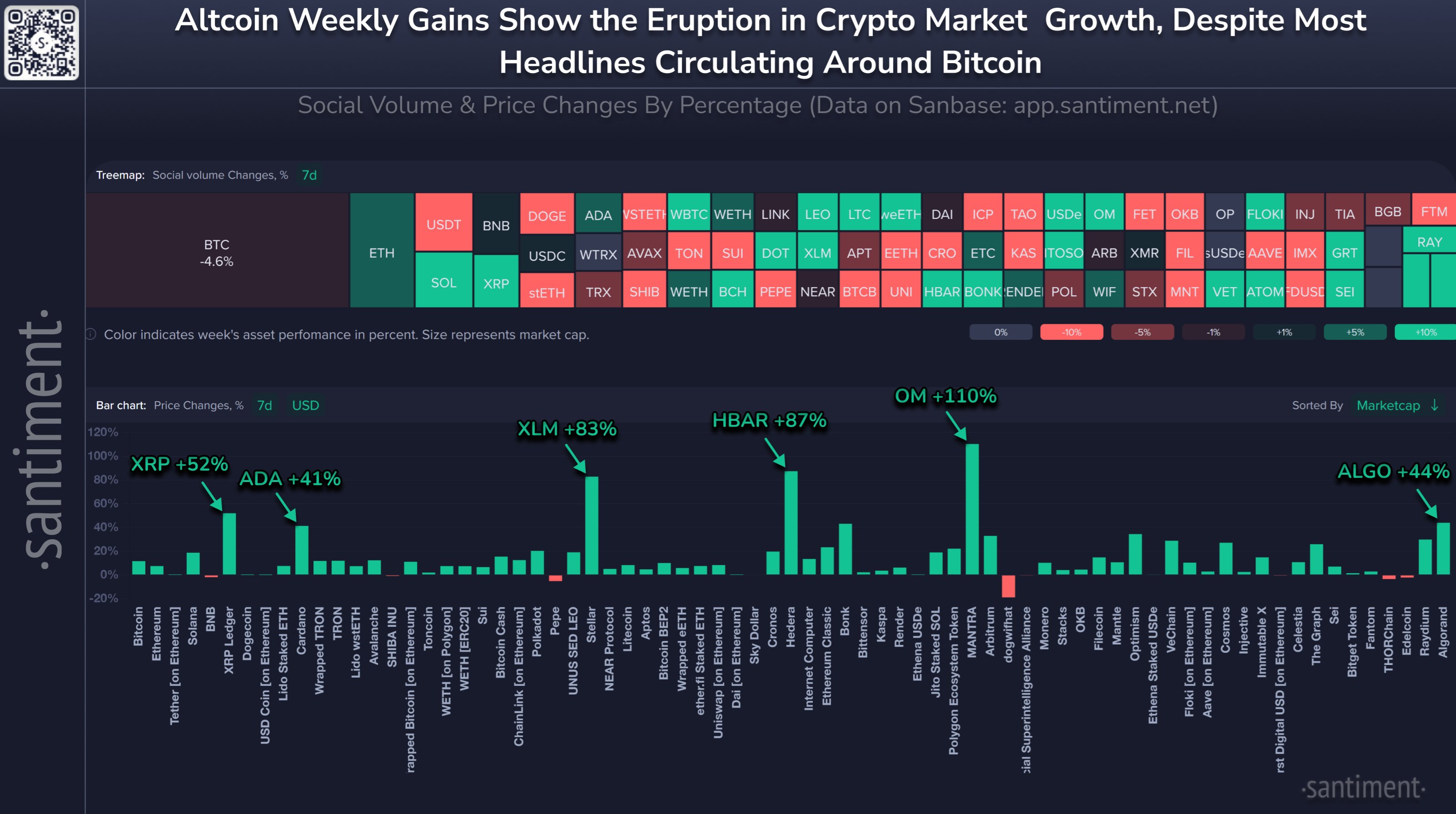

The cryptocurrency market has shown sensitivity to the upcoming election, with Bitcoin’s price falling 4.6% over the past seven days. The digital currency now trades around $68,000, showing a 1.7% decrease in the last 24 hours.

Franklin Templeton, VanEck, and Valkyrie funds collectively reported outflows exceeding $38 million, while WisdomTree’s BTCW and Invesco’s BTCO reported no movement of funds during this period.

The trading week ending November 1 had previously seen $2.2 billion flow into US Bitcoin funds, including a smaller outflow day of approximately $55 million to end the week. This earlier positive trend makes the recent large outflow more notable.

Market analysts have connected these movements to political developments, with CoinShares head of research James Butterfill noting that previous inflows were driven by optimism about a potential Republican victory. Recent polling shifts appear to have influenced investor behavior.

Current polls show a tight race between Kamala Harris and Donald Trump, with Harris leading by 1.2 percentage points according to FiveThirtyEight data from November 4. Betting markets on the Polymarket platform show Trump’s odds at approximately 59%.

The cryptocurrency market faces additional factors beyond the election, with the Federal Reserve’s upcoming policy meeting adding another layer of uncertainty. These combined events have led analysts to predict increased market volatility in the coming days.

Bitcoin’s current trading level of $67,800 represents a nearly 3% decrease in the total crypto market cap to $2.3 trillion. This decline has affected other cryptocurrencies, with Ethereum and Solana both dropping over 3%, while Toncoin and Chainlink experienced 5% decreases.

Historical data shows that Bitcoin typically sees price increases following US elections. After the 2012, 2016, and 2020 elections, Bitcoin’s value rose substantially in the following year, regardless of the winning candidate.

Bernstein analysts have provided specific predictions based on election outcomes, suggesting Bitcoin could reach $90,000 under a Trump presidency or fall to $50,000 if Harris wins. However, these predictions represent market speculation rather than guaranteed outcomes.

The most recent data shows Bitcoin continuing to trade near the $68,000 mark as markets await both election results and the Federal Reserve’s policy announcement.

2 weeks ago

22161

2 weeks ago

22161

English (US) ·

English (US) ·