ARTICLE AD BOX

The crypto market enters a crucial week, with the US CPI inflation figures in focus. In addition, the US Producer Price Index (PPI) data, another critical inflation metric considered by the US Federal Reserve to decide their rate cut plans, is also scheduled for this week. Notably, investors eagerly await this figure as Bitcoin as well as the altcoins sector is gearing up for further rally, potentially hitting new records ahead.

Crypto Market Awaits US CPI Inflation Figures

The crypto market has noted a strong rally recently, with investors anticipating the rally to continue ahead. Now, with the robust Labor market, as evidenced by last week’s Job data, traders are eagerly waiting for the upcoming US CPI inflation figures. For context, the US added 227K jobs in November, up from the market expectations of 220K. Besides, the US unemployment rate also rose to 4.2% in November, up from 4.1% in the prior month.

Notably, the economic indicators tend to influence the broader financial market, let alone the digital assets space. Having said that, inflation and other key figures play a key role in shaping the market sentiment.

Now, investors eagerly await the US Consumer Price Index data, which is scheduled for Wednesday, December 11. According to the market forecast, the inflation is expected to come in at 2.7%, as compared to 2.6% in the prior month. Simultaneously, the Core CPI, which excludes food and energy prices, is expected to cool down to 3.2% from 3.3% noted in October. A hotter-than-anticipated inflation figure usually results in a waning risk-bet appetite of the traders.

On the other hand, the US PPI data, another key metric to gauge inflationary pressure, is scheduled for Thursday, December 12. The market participants would also keep close track of these figures for clarity on the current inflationary pressures in the nation. Notably, the market is expecting the US PPI figures to remain unchanged from last month.

Will Bitcoin & Altcoins Continue To Rally?

The crypto market, along with Bitcoin and the top altcoins has noted a robust rally recently, indicating strong market confidence. Notably, BTC has recently soared past the $100K mark, touching its ATH of $103,900 last week. Notably, the rally started as optimism soared toward pro-crypto regulations in the US after Donald Trump’s election win.

Now, despite anticipation over hot US CPI inflation figures, the market anticipates the Bitcoin and altcoins rally to continue ahead. Although some analysts warned over short-term pullbacks during these bull phase, the digital assets are likely to set new records ahead.

In addition, historical data suggests that Q4 tends to be positive for the financial markets, especially cryptocurrencies. It’s worth noting that so far, the crypto market also showed a similar performance this year as well. Considering that, the economic indicators are not likely to weigh much on the investors’ sentiment ahead.

What’s Next For BTC & Other Crypto?

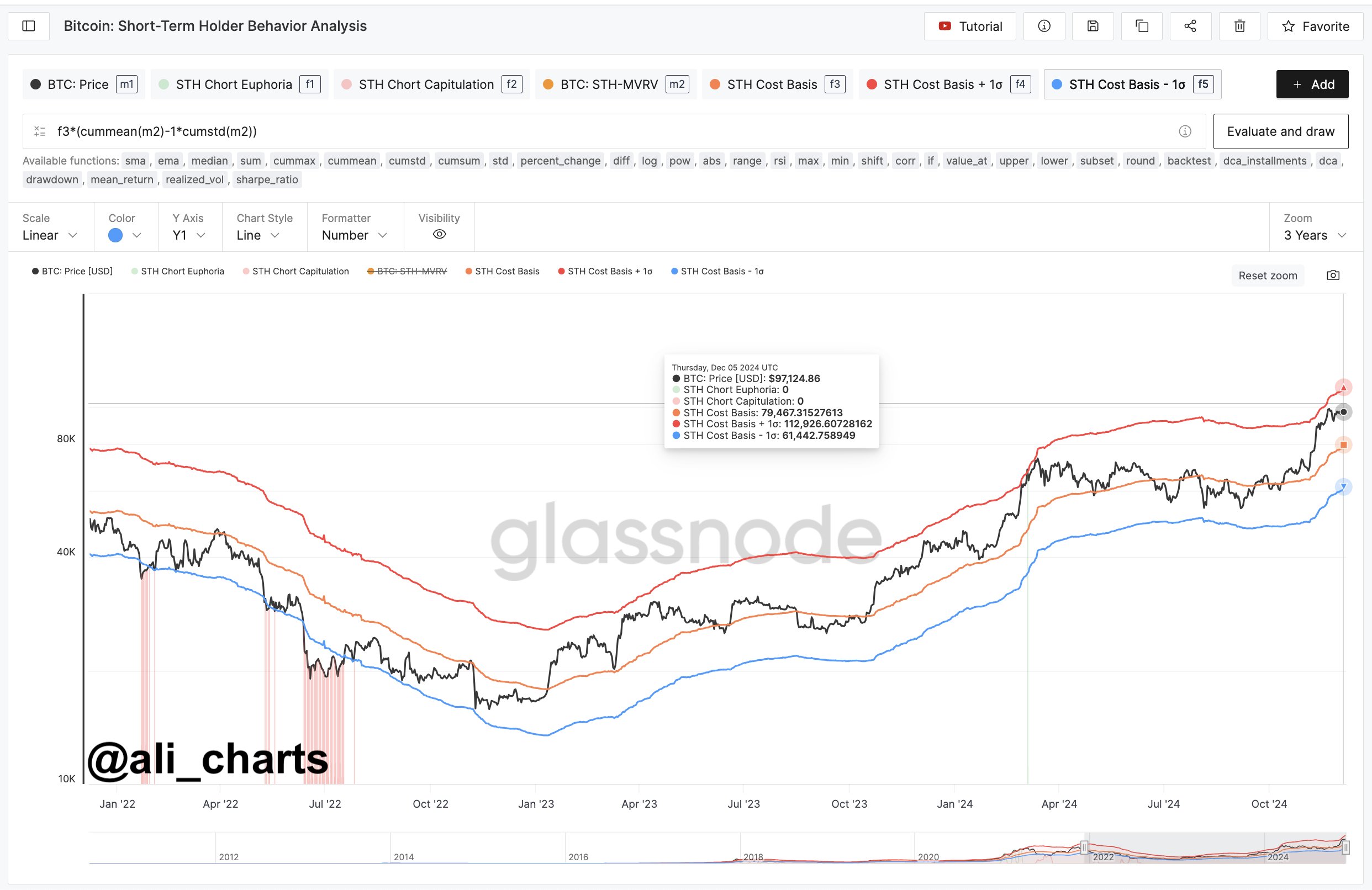

In a recent analysis, top crypto market analyst Ali Martinez said that Bitcoin is poised to reach $112,926, citing technical trends. This has sparked optimism among investors, especially as BTC whales are on a buying spree in recent days.

Source: Ali Martinez, X

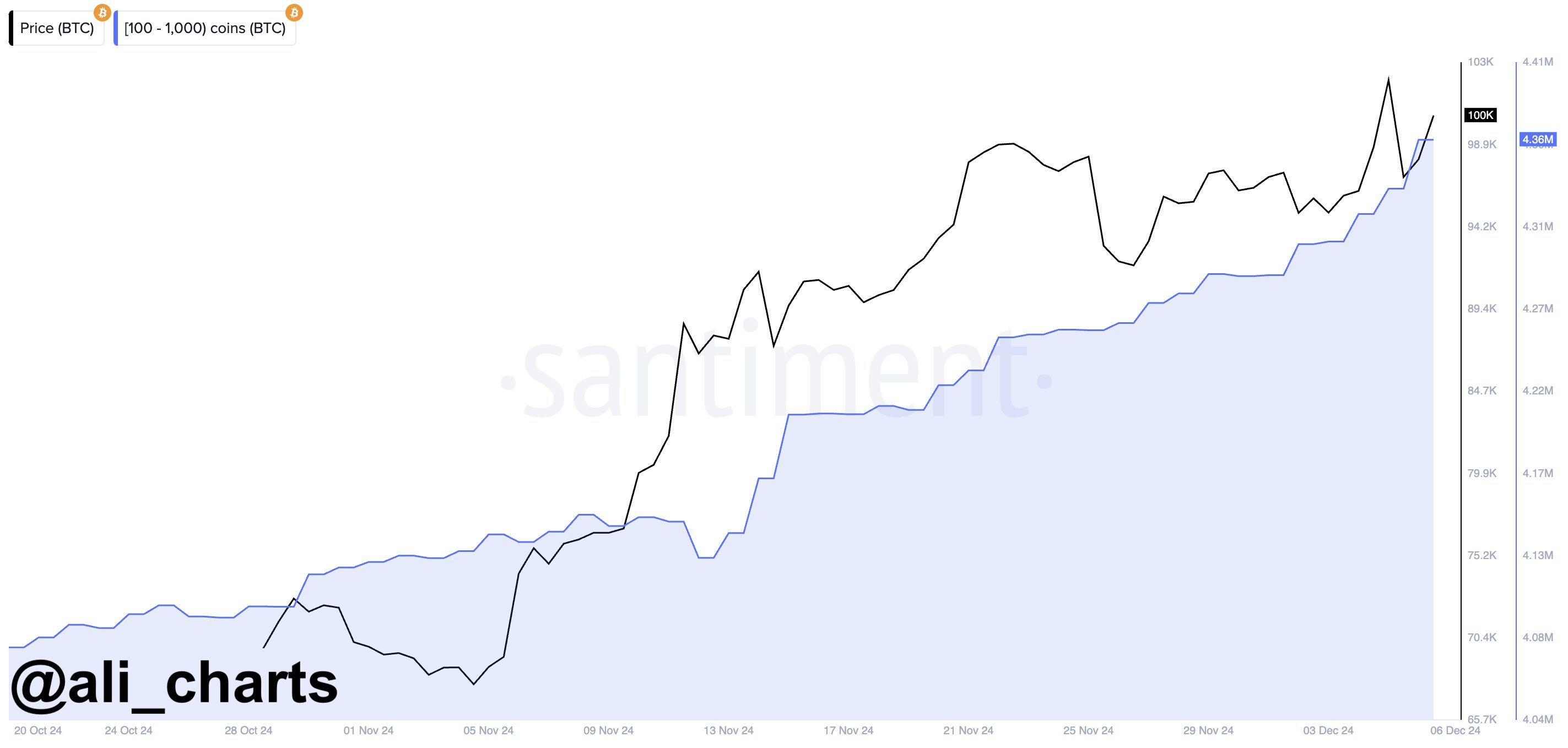

Source: Ali Martinez, XMartinez also said in another post that “Bitcoin whale accumulation is going parabolic.” He noted that recently the whales have purchased 20,000 BTC, worth around $2 billion. In addition, the soaring retail interest also hints toward a further rally ahead. Notably, Marathon Digital (MARA) has accelerated its BTC buying strategy, gaining investors’ attention.

Source: Ali Martinez, X

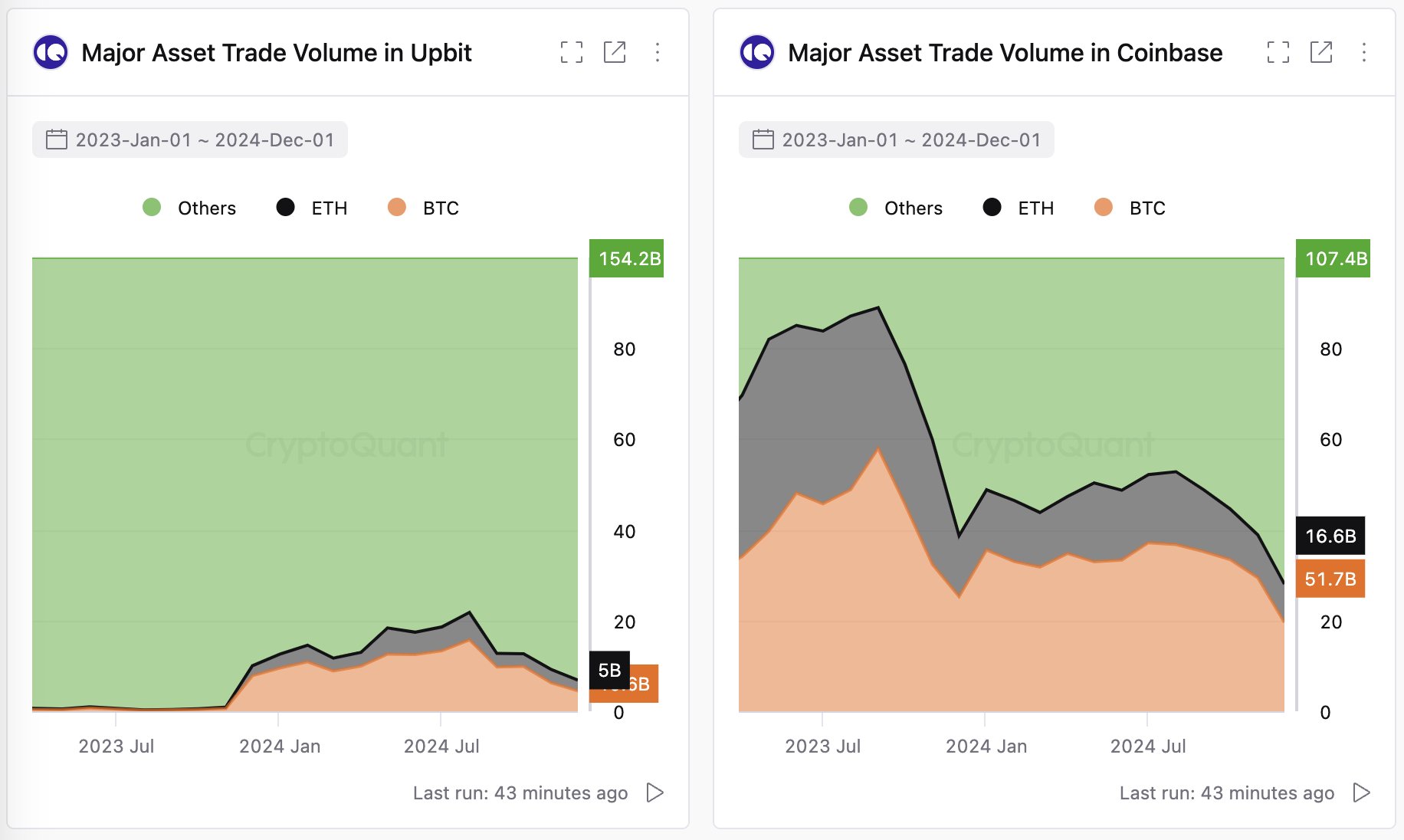

Source: Ali Martinez, XSo far, the altcoins have also followed Bitcoin’s run towards the north. Talking about the altcoin season, CryptoQuant CEO and Founder Ki Young Ju showed confidence in the altcoin market, citing the crypto trading trend in South Korea. In a recent X post, he stated:

“South Korea: The world’s second-largest crypto market, where 93% of trades are altcoins and only 4% are Bitcoin. Every season is alt season.”

Source: Ki Young Ju, X

Source: Ki Young Ju, X

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam's expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news. Rupam's career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

8 months ago

413409

8 months ago

413409

English (US) ·

English (US) ·