ARTICLE AD BOX

Vitalik Buterin, Ethereum co-founder, has addressed concerns surrounding Ethereum’s use as a store of value (SoV) amid EF sell off concerns. In an interaction on X (formerly Twitter), Buterin revealed that approximately 90% of his net worth is held in ETH.

This statement comes amid ongoing discussions in the Ethereum community regarding the network’s role in decentralized finance (DeFi) and the implications of Ethereum’s value in securing the network under its Proof of Stake (PoS) consensus mechanism.

Vitalik Buterin Ethereum Holdings

Vitalik Buterin’s disclosure of his ETH holdings highlights his confidence in Ethereum as a store of value. This revelation follows ongoing debates within the Ethereum community about the platform’s use cases, particularly in DeFi. Some community members have criticized the Ethereum Foundation (EF) for not explicitly promoting ETH’s role as a store of value, a sentiment echoed by DCinvestor, an Ethereum advocate, who pointed out the importance of ETH’s value for the security of the PoS network.

The Ethereum Foundation’s financial activities, particularly its management of large ETH transfers, have also been a point of contention. The recent transfer of 35,000 ETH to the Kraken exchange, worth approximately $94 million, has drawn scrutiny from the community, with concerns about transparency and market impact.

Aya Miyaguchi, Executive Director of the EF, clarified that the transfer was part of the Foundation’s treasury management, which was necessary to cover expenses such as grants and salaries, some of which require fiat payments.

EF Spending and Community Response

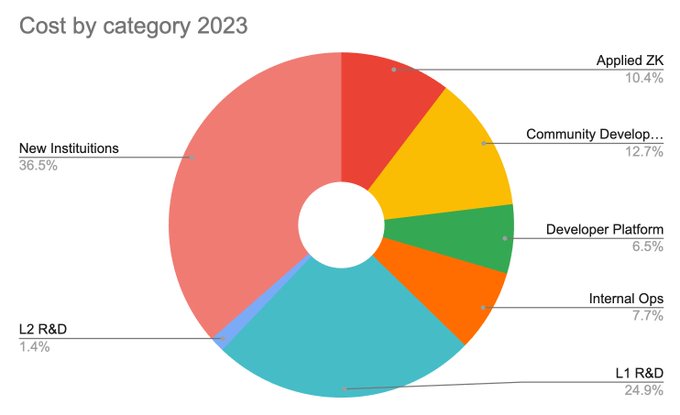

In response to concerns about the Ethereum Foundation’s spending and transparency, Josh Stark, a member of the EF, provided a breakdown of the Foundation’s costs. Stark’s thread on X highlighted internal and external spending, including grants to organizations supporting the Ethereum ecosystem.

The EF plans to release a detailed report covering its spending for 2022 and 2023 before the end of the year, a move aimed at addressing the community’s demand for greater transparency.

Despite the criticism, some community members, including Anthony Sassano of The Daily Gwei, have defended the EF, arguing that the Foundation’s spending is relatively modest compared to Ethereum’s overall market capitalization, which currently stands at around $320 billion.

Concurrently, the discussions about ETH’s value and the Ethereum Foundation’s activities come at a time when Vitalik Buterin’s views on DeFi have also been scrutinized. While Buterin has expressed support for decentralized exchanges (DEXes) and stablecoins, he has raised concerns about the sustainability of yield in DeFi, questioning the long-term viability of yield derived from crypto trading activities.

This ongoing debate within the Ethereum community reflects the broader conversation about the future of DeFi and Ethereum’s role in it. However, Uniswap’s CEO, Hayden Adams, also weighed in on the matter, emphasizing the importance of DeFi in the crypto ecosystem. Adams stated that DeFi remains the most impactful area in the space and that the Ethereum co-founder focus on use cases beyond DeFi is not a cause for concern.

Whales Dumping ETH Amid Market Uncertainty

As discussions around ETH’s value and the Ethereum Foundation’s activities continue, market movements have shown a trend of significant ETH selling by large holders, often referred to as “whales.”

A notable instance involves a whale who recently exchanged 4,591.8 stETH for 4,589.5 ETH, incurring a loss of 2.3 ETH (approximately $6,000) to bypass the lengthy withdrawal process. This whale subsequently deposited 5,145 ETH, valued at $13.3 million, into Binance for sale.

Additionally, Lookonchain reported that another whale sold 19,000 ETH, worth $49.17 million, after withdrawing it from stETH. This series of transactions underscores the ongoing volatility in the market and raises questions about the short-term price trajectory, especially as it hovers around the $2,700 mark with the potential to reach $3,000. Should bulls fail to seize market control, the next support level to watch out for would be at $2,500.

Kelvin Munene Murithi

Kelvin is a distinguished writer specializing in crypto and finance, backed by a Bachelor's in Actuarial Science. Recognized for incisive analysis and insightful content, he has an adept command of English and excels at thorough research and timely delivery.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

(1).png)

1 year ago

497131

1 year ago

497131

English (US) ·

English (US) ·