ARTICLE AD BOX

Bitcoin’s price spiked over the weekend to above $64,000. Crypto market analysts predict that Uptober could usher in a bull run that would see BTC trading above $70,000. Today’s BTC price run nears a 10% surge since the U.S. CPI report read on October 10th, 2024.

Bitcoin Uptober is here

According to on-chain data from CoinGecko, today’s Bitcoin (BTC) price stands at $64,424, up 2.5% in the last 24 hours. The Bitcoin Fear and Greed Index shows investors at a 48 neutral sentiment.

Bitcoin analysts predict that BTC could break through the $65,000 resistance level this week. On-chain data points to the continuation of last week’s bullish momentum.

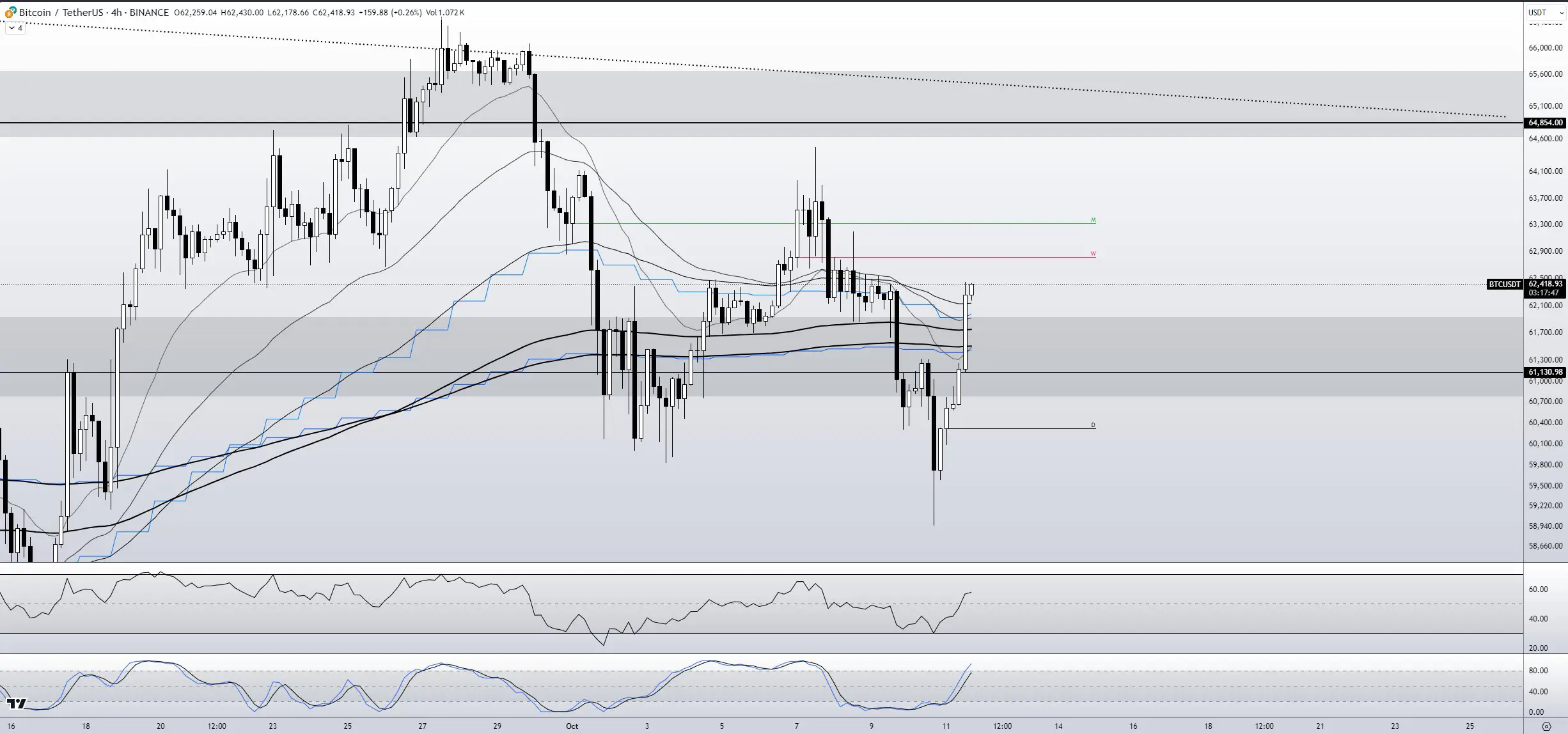

Trading analyst Skew sees the $65,000 level as a critical hurdle for Bitcoin’s bulls. Focusing on the Bitcoin/USDT 4-hour chart skew points that the Relative Strength Index (RSI) is staying above 50, which suggests strong spot demand.

Bitcoin Price movements – Source: X

Bitcoin Price movements – Source: XSecondly, material indicators reinforce the bullish sentiment in the market. The BTC/USDT order book liquidity chart for Binance indicates significant price targets positioned just below the $65,000 mark, particularly around the $64,900 level.

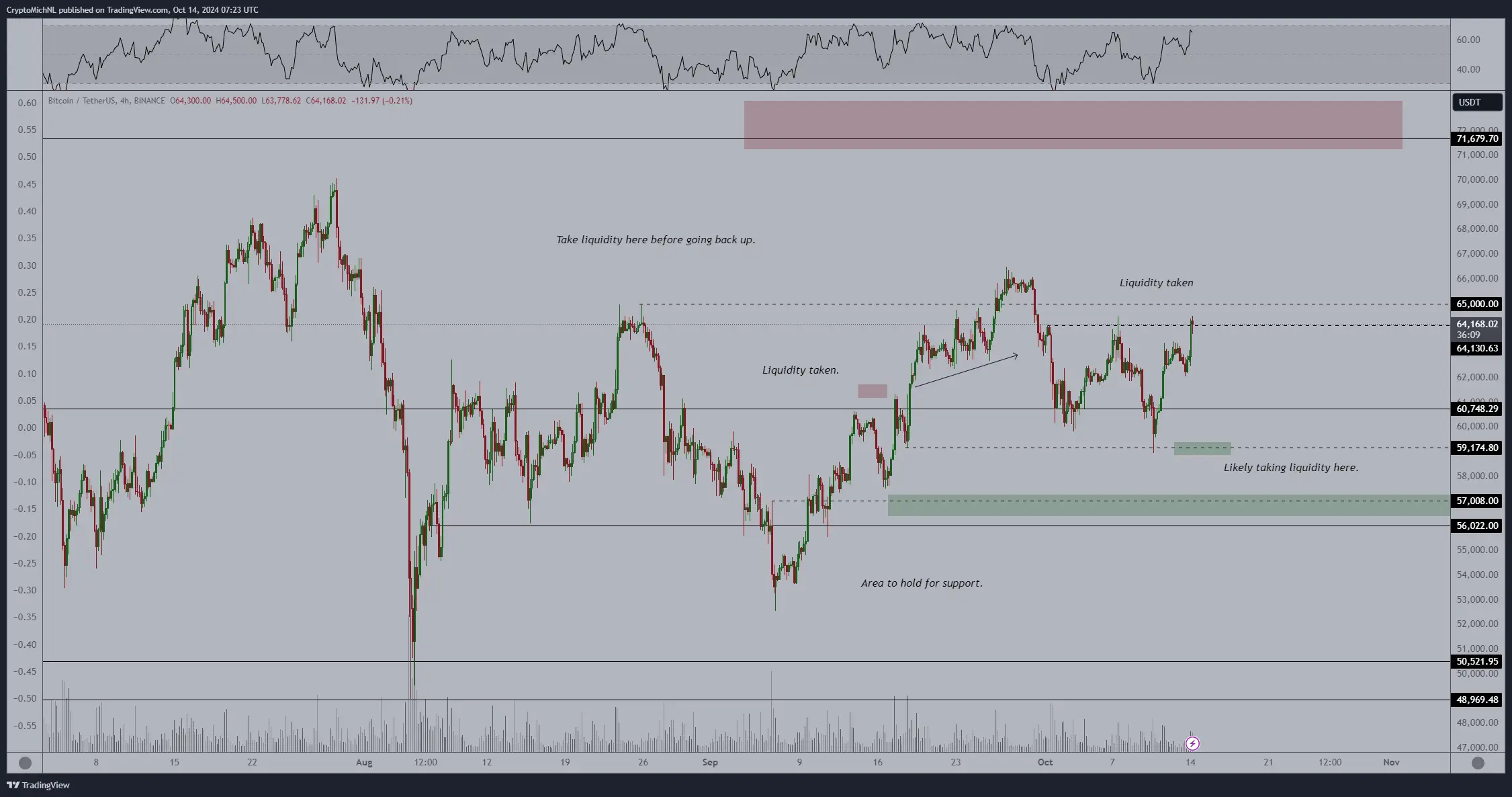

Lastly, crypto analyst Michaël van de Poppe offers a slightly more cautious, yet still bullish, outlook. Yesterday, he pointed out, “Bitcoin consolidating and probably retesting around $61.5K to $62K before continuing its upwards trend. The build-up is massive, and a test of $64,000 could be the key to breaking out.”

Bitcoin Price movements – Source: X

Bitcoin Price movements – Source: XIn the last hour, his theory was tested right. He points out, “Bitcoin did test $62K and is facing the crucial resistance zone. Expecting to see a breakout upward happen this week / next week as Uptober is finally expanding.”

Bitcoin could finally be seeing the bull rally investors have been watching out for since the BTC halving in April. This is in addition to the rally expected to come with the Spot BTC ETFs approvals in January.

(1).png) 1 month ago

33083

1 month ago

33083

English (US) ·

English (US) ·