ARTICLE AD BOX

The Bitcoin price is again looking to reclaim the $70,000 level on the US election day. Following a brief break above this price level, Bloomberg analyst Eric Balchunas commented on why the flagship crypto could be an important indicator as the election kicks off.

Why Bitcoin Price Is Important On US Election Day

In an X post, Bloomberg analyst Eric Balchunas opined that Bitcoin price looks like a clean indicator to watch as the US election takes place today. He explained that he holds this belief because it was an issue when Donald Trump and Kamala Harris campaigned.

Indeed, Bitcoin and cryptocurrencies, in general, were at the heart of the build-up to this election. Donald Trump has declared his support for Bitcoin and cryptocurrencies since the start of the year. The former US president also recently promised to end Kamala Harris’ war on Bitcoin if elected.

On the other hand, Kamala Harris failed to clearly state her position regarding crypto, although she mentioned it in relation to other issues.

Balchunas’ comment came as the Bitcoin price touched $70,000 as the election kicked off. Bitwise Chief Investment Officer (CIO) Matt Hougan also agreed with the Bloomberg analyst and said he has been thinking the same. In response, Balchunas remarked that Bitcoin’s movement looks to be correlated with Trump’s odds.

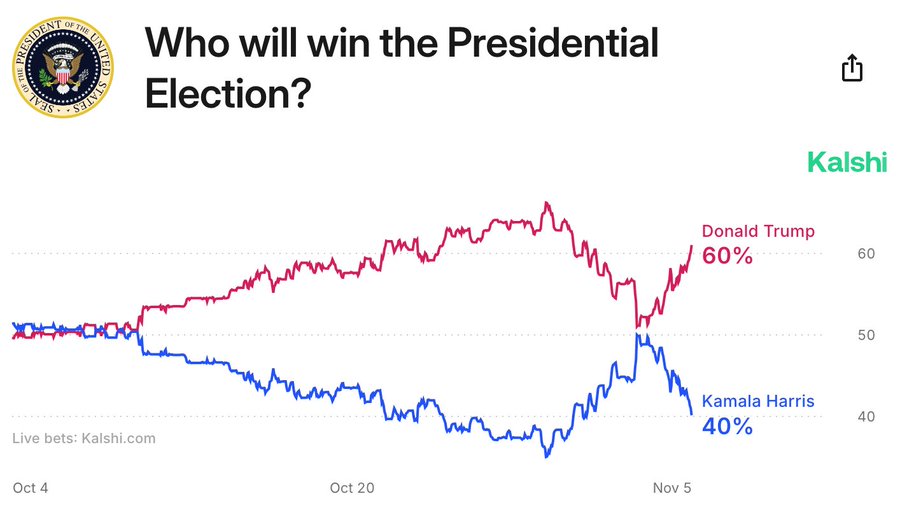

Indeed, this could be true as the latest Kalshi data shows that Donald Trump’s odds of winning the elections are back at 60% on Election Day. This development presents a bullish outlook for the flagship crypto since the former US president is the pro-crypto candidate.

BTC Doesn’t Care About The Winner But A Trump Victory Might Still Matter

History shows that the Bitcoin price will thrive regardless of who wins the US elections. The flagship crypto has always reached new all-time highs after every US presidential election cycle. This time looks unlikely to be different whether Donald Trump or Kamala Harris wins.

However, a Trump victory might still matter for other reasons. Crypto analyst Crypto Kaleo explained how the potential winner could determine what direction the crypto industry heads in. He added that they can shape the crypto industry and determine where it continues to grow.

The analyst made this statement in relation to crypto regulation in the US. While the Bitcoin price may be unaffected by the result of the election, the crypto industry in the country could suffer a great deal, especially if the regulatory environment in the next administration is similar to the one under the Biden administration.

This is why Donald Trump looks to be the favored candidate in the crypto community. The former US president has promised to fire the US Securities and Exchange Commission (SEC) Chair Gary Gensler on day one.

Although there are still legal debates about whether Trump can only demote Gensler, this is undoubtedly significant, considering how the SEC, under Gensler, has clamped down on crypto firms in the US through enforcement actions.

The need for regulatory clarity has forced crypto firms like Coinbase to sue the US FDIC with the top crypto exchange securing a major win the FOIA case. However, the need for these legal battles could be a thing of the past under a potential Donald Trump administration.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

2 weeks ago

26660

2 weeks ago

26660

English (US) ·

English (US) ·