ARTICLE AD BOX

XRP saw massive buying by institutional investors as the U.S. Securities and Exchange Commission and Ripple agreed to continue the legal fight in the Second Circuit Court of Appeals. With Ripple’s recent SEC lawsuit win in a district court and an upper hand in the circuit court, investors seemed more upbeat about a huge upcoming rally in XRP price.

Institutional Investors Buying XRP Heavily

XRP saw $1.1 million in buying from institutional investors last week as compared to $0.3 million in the earlier week, as per CoinShares report on October 14. Thus, a 266% rise in buying activity was recorded week-over-week as Ripple and the US SEC prepared for appeals in the circuit court.

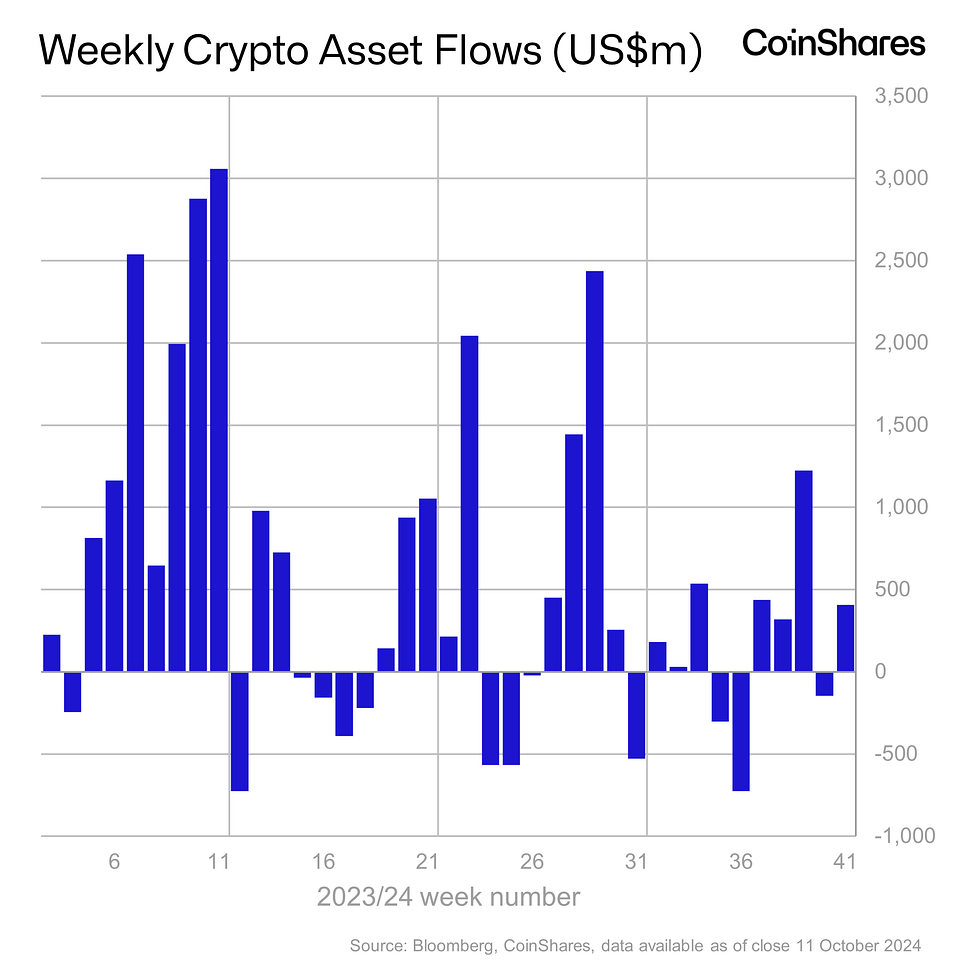

Digital asset investment products witnessed $407 million in net inflows in a week as investors remained bullish on an ‘uptober’ rally, coinciding with upcoming US elections. Investors ignored the rise in CPI and PPI inflation in the U.S. to continue buying the dips.

Amid the major XRP news, total XRP futures open interest also climbed over 3% in the last 24 hours. The futures OI has reached 1.39 billion worth $750.53 million.

Ripple Vs SEC Lawsuit Moved to Second Circuit Court

US SEC appealed against Judge Torres’ $125 million penalty decision in the remedies phase, instead of almost $2 billion in fines solicited by the agency. Form C and Form D filings with complete details on the appeal are due this week. The crypto community has slammed the SEC for appealing and stretching the long-running case.

Meanwhile, Ripple filed a notice of cross-appeal clearing its intention to oppose the SEC’s irrational appeal of Judge Torres’ ruling. Ripple CEO Brad Garlinghouse added that the cross appeal will seal the SEC’s fate and finally put an end to the regulation-by-enforcement agenda by the agency under Chair Gary Gensler.

Former SEC lawyers such as Marc Fagel and James Farrell believe the SEC will challenge programmatic sales, as well as secondary sales. US SEC has started suing and probing crypto-related companies for secondary market sales, which Judge Torres did not address in her landmark summary judgment last year.

Also, Bitnomial sued the U.S. SEC over the agency’s claim that XRP is a security despite clarity from the court. Moreover, lawyer Bill Morgan questioned the SEC’s rationale behind treating the futures as security futures contracts. He slammed the inconsistency in regulatory enforcement, especially when comparing XRP to similar cases with Ethereum (ETH), where the SEC had previously shown no objections to the futures contracts.

Varinder Singh

Varinder has 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently covering all the latest updates and developments in the crypto industry.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

1 month ago

32778

1 month ago

32778

English (US) ·

English (US) ·